By Scott Irwin

Department of Agricultural and Consumer Economics

University of Illinois

Each year the USDA’s National Agricultural Statistics Service (NASS) provides estimates of planted acreage of corn and soybeans in the U.S. These estimates provide important fundamental information about potential crop size and have important implications for the price of corn and soybeans. As a result, market participants spend considerable effort in forming expectations about the magnitude of these acreage estimates. Since 2011, the USDA’s Farm Service Agency (FSA) has also issued monthly reports of planted acreage to the public beginning in August based on farmer reports received and summarized to date. These data are normally used by NASS to “true up” survey-based planted acreage estimates in the October Crop Production report. NASS announced yesterday that FSA reporting was complete enough to date in 2021 that acreage revisions based on FSA (and other) data would occur in the September Crop Production report, which will be released on September 10th. We have examined the relationship between the preliminary FSA planted acreage for corn and soybeans and final NASS planted acreage in earlier farmdoc daily articles (January 27, 2016, August 27, 2020). The purpose of this article is to update those relationships and predict revisions to NASS planted acreage estimates for corn and soybeans in 2021.

Analysis

FSA policy requires that producers participating in several Federal commodity programs submit an annual report regarding all cropland use on their farms, including planted acreage and prevented plant acreage. (See the farmdoc daily article from August 20, 2020 for analysis of FSA prevented plant acreage data). The deadline for reporting acreage each year is July 15th for most crops. In consideration of the COVID-19 pandemic, the FSA waived the late fee for 30 days in the summer of 2020. The FSA issues monthly reports of planted acreage to the public beginning in August based on farmer reports received and summarized to date. The final report is released in January and, in theory, that data represent a complete census of planted acreage enrolled in the farm programs administered by the FSA.

While FSA acreage data represent a census of planted acreage enrolled in farm programs, the FSA acreage data do not function as official USDA planted acreage estimates. This makes sense because not all farms are enrolled in the farm programs administered by the FSA. The official planted acreage estimates are the responsibility of NASS, a different agency in the USDA. The progression of official NASS planted acreage estimates for the year begins with the Prospective Plantings report released on the last business day of March, is followed by the Acreage report released on the last business day of June, and finally the Crop Production Annual Summary report released in January after harvest. As noted earlier, FSA data on planted acreage released in October are typically used by NASS to adjust their survey-based planted acreage estimates in the October Crop Production report. NASS recently announced that FSA reporting was complete enough so far in 2021 that acreage revisions based on the administrative data would occur in the September Crop Production report. Finally, it should be emphasized that the FSA data are used by NASS to supplement survey data and there are likely statistical limits on the magnitude of changes in estimates made based on the FSA data. Conversations with NASS statisticians indicate the changes are typically no more than one standard error from the previous estimate.

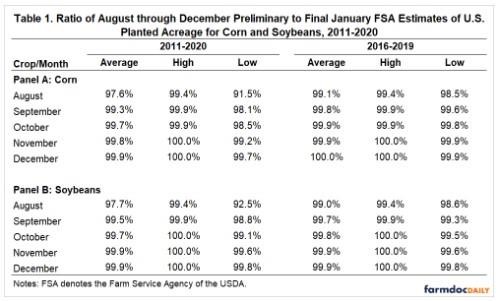

We begin our analysis by reviewing the relationship between the preliminary and final planted acreage estimates for corn and soybeans from 2011 through 2020. The time period is selected based on the availability of FSA data at the FSA website. As shown in Table 1, all but a very small slice of planted acreage for corn and soybeans is generally reported to the FSA by August. For example, over 2011-2020 the average ratio of preliminary to final FSA planted acreage for corn and soybeans is 97.6 and 97.7 percent, respectively. The average ratios both move above 99 percent in September and reporting is virtually complete by October.

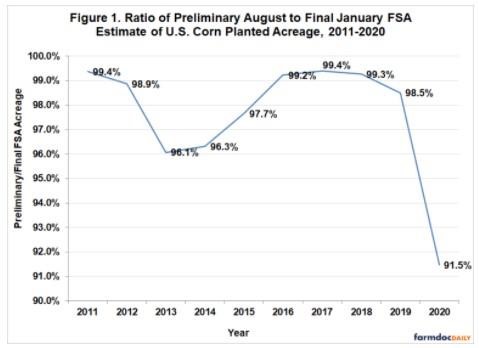

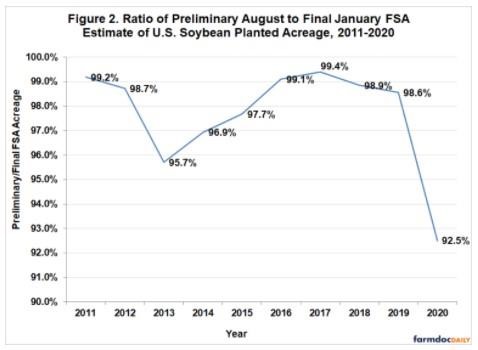

There is some variation in the relationship between preliminary and final prevented plant acreage that is obscured by the averages over 2011-2020 in Table 1. For example, Figures 1 and 2 present the yearly ratios for corn and soybeans in August, respectively. Three things stand out. First, there was a drop in reporting during 2013 and 2014, possibly due to the transition to new rules under the 2014 farm bill. Second, there was overall an upward trend in reporting for August from 2015-2019. Third, reporting during August literally fell off of a cliff during 2020 due to the reporting extension during the COVID pandemic. Consequently, we also present statistics for the ratio of preliminary and final planted acreage in Table 1 only for the four years between 2016-2019. We argue this is likely to be the most representative part of the sample for making 2021 projections. The average ratio for corn and soybeans in August increased to 99.1 and 99.0 percent, respectively, for 2016-2019.

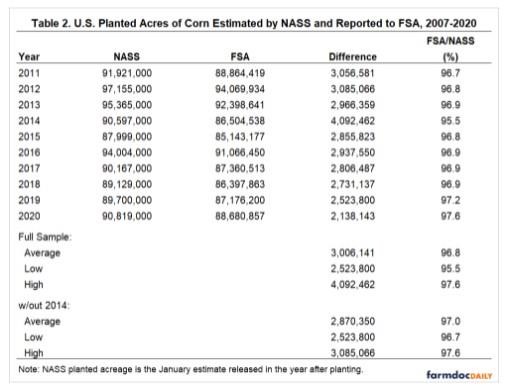

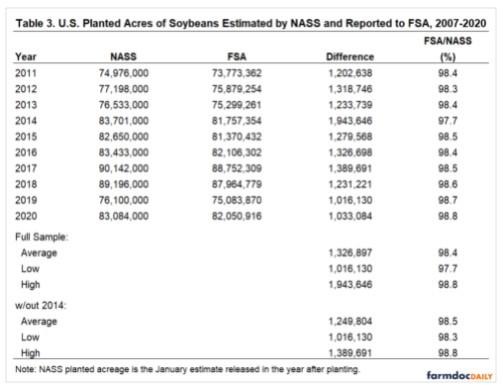

The next step of the analysis is to examine the relationship between final FSA and NASS estimates of planted acreage. Tables 2 and 3 for corn and soybeans, respectively, show that the relationships are quite consistent. For corn, the final FSA estimate of planted acreage averages 96.8 percent of final NASS planted acreage over 2011-2020 and the range is slightly more than 2 percent. For soybeans, the final FSA estimate of planted acreage averages 98.4 percent of final NASS planted acreage over 2011-2020 and the range is only 0.5 percent. Finally, the average percentages change only slightly if the lowest observation (2014) is excluded. The consistency of the relationships make sense because enrollment in FSA farm programs varies relatively little from year-to-year.

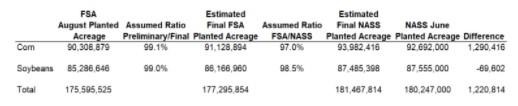

We now have the necessary information to project final NASS planted acreage for corn and soybeans in 2021 based on the planted acreage in the August 2021 report issued by the FSA. The computations are as follows:

Notice that there are two stages in the computations. The first is to estimate final FSA planted acreage by dividing the reported August FSA figure by the assumed ratio of preliminary to final FSA acreage. In this case, we use the 2016-2019 averages for this ratio. The second step is estimate the final NASS planted acreage by dividing the estimated final FSA planted acreage by the assumed ratio of final FSA to NASS planted acreage. We use the averages over 2011-2020, after excluding 2014, to estimate these ratios. Given these assumptions, we estimate final NASS planted acreage for corn and soybeans to be 93.982 and 87.485 million acres, respectively. This implies an upward revision of 1.29 million acres for corn and a downward revision of 0.070 million acres for soybeans compared to the estimates in the 2021 NASS June Acreage report. It is important to remember that the estimated revisions are somewhat sensitive to the assumed ratios for FSA preliminary/final reporting and the final FSA/NASS estimates.

Implications

Since 2011, the USDA’s Farm Service Agency (FSA) has issued monthly reports starting in August of planted acreage based on farmer reports received and summarized to date. This data is widely following in the market for clues about possible future revisions to the official USDA planted acreage estimates for corn and soybeans. We show that all but a very small slice of planted acreage for corn and soybeans is generally reported to the FSA by August. We also show that the relationship between final FSA and NASS planted acreage is quite stable for the two crops. Using these relationships, we project final NASS planted acreage for corn and soybeans in 2021 based on the FSA estimates released in August. These estimates are 93.982 and 87.485 million acres, respectively, for corn and soybeans. This implies an upward revision of 1.29 million acres for corn and a downward revision of 0.070 million acres for soybeans compared to the estimates in the 2021 NASS June Acreage report. It will be interesting to compare these projections to the planted acreage revisions that NASS recently announced will be released in the upcoming September Crop Production report.

Source : illinois.edu