How will trade flows shift over time?

By Aleah Harle, Farms.com Risk Management Intern

On March 12, the European Union announced $28 billion in retaliatory tariffs on U.S. products, following President Trump’s decision to impose 25% tariffs on all steel and aluminum imports.

Originally set to take affect April 1, but now postponed to mid-April, the most significant agricultural targets include corn and soybeans – two of the top five U.S. agricultural exports by value.

With these key commodities now in the crosshairs, the question remains: How much will these tariffs actually impact U.S. grain demand?

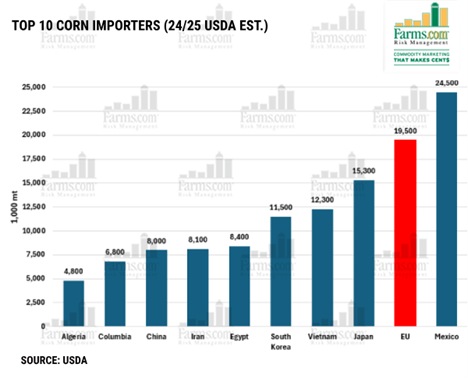

The U.S. exports approximately 3-4 million tons of corn to the EU each year, representing 4% of total U.S. corn exports, but the 2nd largest buyer after Mexico in the world.

Soybeans, in contrast, make up a larger portion of EU imports, with 5-7 million tons of soybeans being sent to the region annually, representing 10% of total U.S. soybean exports. (Please see chart below)

Thus far this marketing year, the EU has purchased 2.5 million metric tons of corn, with nearly 100% of these sales already being shipped – suggesting a minimal immediate impact on the corn market.

Similarly, the EU ranks as the second-largest buyer of U.S. soybeans, having purchased 4.5 million metric tons, the majority of which have also been shipped.

Wheat exports to the EU remain relatively small, accounting for just 3% of total U.S. export sales.

From a fundamental standpoint, the impact on corn, soybeans, and wheat exports appears limited. However, uncertainty lingers regarding future crop purchases, as ongoing trade tensions could disrupt demand.

While the initial announcement caused some volatility in the grain markets, the underlying fundamentals are suggesting a more muted short-term effect.

As mentioned, on a year-to-year basis, the EU ranks as the second-largest importer of both corn and soybeans, bringing in 19.5 million metric tons and 14.6 million metric tons total, per year, respectively. These are the figures now at risk, highlighting the main issue at hand.

The U.S. would ultimately bear the cost, as higher prices for EU products would weaken the competitive position of EU exports to the U.S. The key question now is where the EU will source these imports, potentially reducing demand for U.S. grains and leading to oversupply issues.

A reduction in EU grain imports could lead to increased demand for domestic European grains or sourcing from other partners such as Brazil and Argentina. This would create competitive pressure in other markets, as suppliers like Canada, Brazil, and Ukraine redirect their grains elsewhere, increasing competition for U.S. exports. If Brazil, for example, faces EU tariffs on corn, it may sell more to China, potentially reducing U.S. market share.

These trade shifts could lead to greater global grain supply in non-EU markets, potentially pushing prices lower.

In the short term, the direct impact of EU tariffs on U.S. grains seems limited, but the bigger concern is how trade flows will shift over time. As the EU turns to other suppliers, U.S. exporters could face more competition in key markets, putting pressure on prices. Ongoing trade tensions also add uncertainty about future demand, making it harder for farmers to plan ahead.

While the market reacted with some volatility at first, the long-term effects will depend on how trade relationships shake out and whether the U.S. can find new buyers to make up for potential losses in the EU or a trade deal is negotiated. The funds will continue to reduce risk, “when in doubt, get out.”

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.