By Joana Colussi and Nick Paulson, et.al

Brazil, the world’s second-largest producer of ethanol, has experienced a dramatic increase in the growth of ethanol processing plants in the nation’s Center-West. In contrast to the United States, the world’s largest ethanol producer, most Brazilian ethanol is made from sugarcane. However, corn ethanol plants are being built throughout the Brazilian states of Mato Grosso, Mato Grosso do Sul, and Goiás – where the volume of the second crop of corn has grown rapidly in the last decade. The size of the annual corn harvest, and the expected increase in ethanol consumption in Brazil and abroad, are the main factors encouraging the proliferation of processing plants. This article examines the evolution of total corn ethanol production in Brazil since the early stages of the industry a decade ago, advantages and challenges in using corn rather than sugarcane as a feedstock, and perspectives for the future.

The Growth of Corn Ethanol

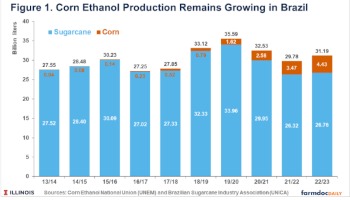

Corn ethanol plants began appearing in the last decade in Brazil, especially in the Center-West region. Corn ethanol production jumped from 40 million liters in the 2013/14 season to 4.43 billion liters in the 2022/23 season, which runs from April to March in Brazil, according to data from the National Corn Ethanol Union (UNEM) – an institution founded in 2017 to represent the interests of the expanding industry. Meanwhile, sugarcane ethanol has remained relatively stable around 27 million liters from 2013/2014 to 2022/23, according to the Brazilian Sugarcane Industry Association (UNICA).

Brazil has been producing corn-based ethanol since 2014. The first output came from sugar mills that had been modified to use corn when sugarcane was not available during the summer wet season (USDA, 2020). Due to the success of early retrofitting, more mill operators have decided to invest in year-round processing of multiple ethanol feedstocks. Additionally, new ethanol mills have been designed and built that are capable of processing either corn or sugarcane, or corn only.

Corn has some advantages over sugarcane, but corn also presents some challenges. Ethanol plants in Brazil are powered by burning biomass as access to natural gas can be very expensive. Most ethanol production facilities use biomass from sugarcane, called bagasse, as the fuel source. Eucalyptus biomass is the primary fuel used in corn ethanol plants, although some businesses are testing alternate biomass sources (USDA. 2020). While sugarcane is its own biomass that can be used as fuel, it has a limited growing season and cannot be stored because it starts fermenting as soon as it is cut. Corn ethanol plants can produce year-round and make a variety of coproducts, such as corn oil, Distillers Dried Grains (DDG), and Distillers Dried Grains with Soluble (DDGS).

There are also some differences in the production efficiency of plants depending on which crop they are processing. Ethanol can be produced from sugarcane with a yield of 80-85 liters per ton, while the yield from corn is 410-430 liters per ton, according to UNICA. However, sugarcane ethanol yields 6,500-7,500 liters per hectare, while corn ethanol yields 2,000-3,500 liters per hectare. Another difference is that the corn ethanol industry does not have its own planted area. Meanwhile, through more vertical integration, the sugarcane ethanol industry has its own planted area and stronger direct relationships with sugarcane suppliers.

High Concentration in Center-West Region

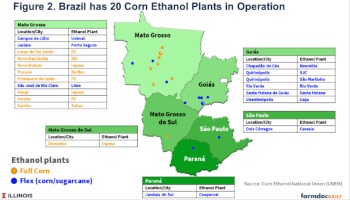

Currently, there are 20 ethanol plants in Brazil utilizing corn as the feedstock. They are located in the states of Mato Grosso (11 units), Goiás (6 units), Mato Grosso do Sul (1 unit), Paraná (1 unit), and São Paulo (1 unit). Nine plants are corn-only, while the rest are flex plants producing ethanol from sugarcane and corn (see Figure 2). In addition, 10 other businesses have received construction authorization, which would bring Brazil´s production capacity to 9.6 billion liters of corn ethanol by the 2030/2031 season, according to the UNEM forecast.

While flex plants usually process sugarcane at the height of that crop’s harvest season and switch to corn for about three months during the “inter-harvest” period, full plants are committed to processing corn only, year-round. Although the cost of building a flex facility can be 30 to 40 percent higher than what it costs to build a corn-only plant, flex plants generate more money than sugarcane-only plants, which typically sit idle for several months (USDA, 2020).

The first corn-only ethanol plant in Brazil was built in 2017 by FS Bioenergia, a joint venture of Tapajós Participações S.A and Summit Agricultural Group from Iowa, U.S. The company has two facilities in the state of Mato Grosso, in the towns of Lucas do Rio Verde and Sorriso (see Figure 2). FS Bioenergia has started building a third facility in Primavera do Leste, in the same state.

Paraguayan ethanol producer Inpasa opened its first corn-only ethanol plant in August 2019, in the city of Sinop, Mato Grosso, and a second plant in 2020 in the town of Nova Mutum. Both are near Highway BR-163, the main corridor connecting Center-West production to port facilities on tributaries of the Amazon River. The strategic location makes it cheaper for industries to purchase corn supplies and sell the ethanol, DDGS, and corn oil to northeastern Brazil or abroad.

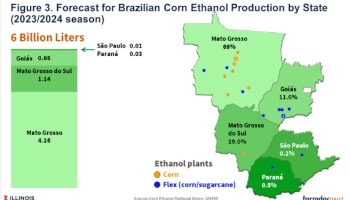

Corn Ethanol Close to Accounting for 20% of Total Production

Brazilian corn ethanol production could reach almost 6 billion liters in the 2023/24 season, an increase of 35% over last season. As a result, corn ethanol is expected to account for almost 20% of all ethanol consumed in the country, up from 14% in the previous season, according to UNEM. Mato Grosso leads production, with 69% of total corn ethanol production in Brazil, followed by Mato Grosso do Sul (19%), and Goiás (11%), in the Center-West (see Figure 3).

A large part of the increase in corn ethanol production in Brazil is a result of the expansion of second crop corn, known as “safrinha”, which is grown mainly in the Center-West and is planted after the yearly soybean harvest. In the last decade, Brazil’s second crop corn has more than doubled in volume, reaching an estimated record of 4,030 million bushels in the 2022/23 crop season, an 11% increase over the previous year, according to Agroconsult, a private Brazilian consultancy. Safrinha corn accounts for more than three-quarters of Brazil’s corn production in the 2022/23 crop season.

The states of Mato Grosso, Mato Grosso do Sul, and Goiás, which account for 99% of corn ethanol production, are responsible for 57% of total corn production in Brazil, according to the National Supply Company (Conab). Farmers in these states usually plant corn as a second crop immediately after the soybean harvest. The climate in that region enables farmers to cultivate two crops on the same land each year. Most producers plant corn when the soybean harvest is complete, typically in February.

The availability of low-cost corn from safrinha in the Center-West of Brazil is another factor that attracted national and international companies to invest in corn ethanol production in Brazil. Corn prices in that region are typically lower than in the South, where the livestock and poultry industries are concentrated. About 50% of Brazilian corn production is consumed by animal feed and 10% by ethanol plants in the domestic market. The remainder, close to 30% of corn production, would be available to export (see farmdoc daily, March 16, 2023).

There are some factors limiting growth of the corn ethanol sector. One is the low population density of the Center-West, which creates a lower demand for fuel. Another challenge is that there are limited options to transport ethanol out of the region. Most ethanol would have to travel around 800 miles by truck before being transferred to barges or ports in the Southeast, where the port structures for exporting ethanol are concentrated. Another limitation is the limited storage capacity for corn and ethanol in Brazil, which makes it difficult in periods of large production and price fluctuations (Fava Neves, 2021).

Summary

Ethanol plants capable of utilizing corn as a feedstock are increasing in numbers in Brazil. This expansion is mainly occurring in the Center-West states of Mato Grosso, Mato Grosso do Sul, and Goiás where second crop corn production continues to increase, and logistics issues create incentives to find more local uses for the corn. Compared with the more traditional ethanol feedstock of sugarcane, corn offers some advantages but also some challenges to Brazilian ethanol producers. Trends suggest the corn-based ethanol industry will continue to expand in the future as it approaches 20% of total ethanol production in Brazil.

Source : illinois.edu