By Don Shurley

If you feel like you are “behind” in your pricing/price protection and have been waiting for opportunity to get caught up, here you go. We mentioned a couple of weeks ago that prices (December futures) were most likely to range from 78 to 86 cents depending on weather, demand and exports, and other factors. We have now moved to the upper side of that quicker than anticipated.

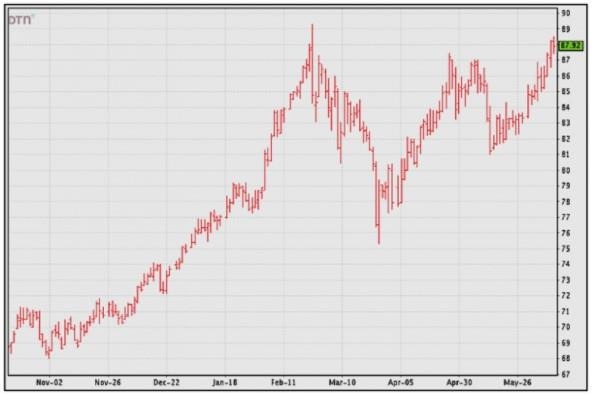

Through Friday last week, new crop December futures had advanced 6.7 cents since mid-May. December gained 2.04 cents for the week last week—setting a new contract high at over 88 cents on Thursday. The week closed with a slightly down day on Friday at 87.92 cents.

We now have a potential “triple top” forming at 87 to 88 cents. What does that mean to the grower in common sense language? It means price has tried to break the “ceiling” at 87 to 88 cents 3 times now but has been unable yet to do so. NOTE—prices are down sharply today.

Weather across the cotton belt has become a real mixed bag—improved in some areas, still dry in some areas, needing to dry out in other areas. Weather has been one factor contributing to the upward price trend over the past few weeks.

USDA released its June supply/demand estimates on Thursday of last week. The numbers were very favorable and supportive for prices.

- Exports for the 2020 crop marketing year were revised upward 150,000 bales. An increase was expected and this further lowers the carry-in to the 2021 crop year effective August 1.

- Exports for the upcoming 2021 crop year were raised 100,000 bales to 14.8 million bales.

- This will also depend on US production, but US ending stocks for the 2021 crop marketing year are now projected to be less than 3 million bales. If realized, this would be the lowest since 2016 and lowest total available supply since 2015.

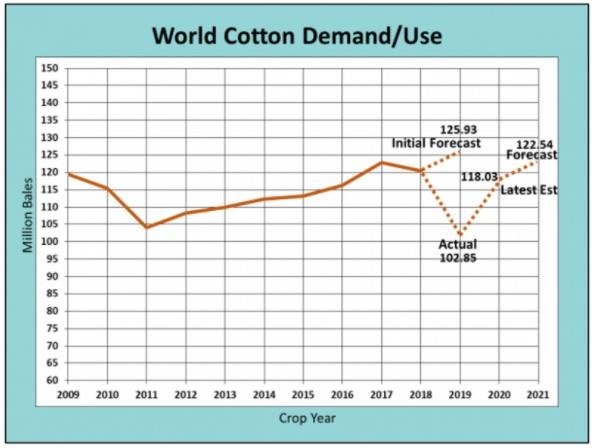

- World demand/Use for the 2020 crop year was revised upward 620,000 bales. If realized, this would be 14.8% growth for the year.

- World demand (Use) for the upcoming 2021 crop marketing year was revised upward by 1.06 million bales to 122.54 million.

- Use for the 2021 crop year is projected to exceed production by 3.67 million bales, so World ending stocks continue to shrink.

- Compared to initial estimates last month for the 2021 crop year, China’s production for the 2021 crop was lowered 750,000 bales, Use raised 1 million bales, and imports raised 500,000 bales.

Last weeks export report (for the week ending June 3) was “fair”. Sales were 155,500 bales. Shipments were 283,400 bales.

Prices are being fueled by expected continued strength in Use and, at this point, much uncertainty in the US crop. This months 1 million bale bump-up in projected 2021 crop demand is further evidence of current optimism. The first estimate of US actual acres planted will be out on June 30. This is a huge unknown due to weather and high prices for competing crops. The June 30 number may help settle the direction this market ultimately takes.

Could price go higher? Yes. But if you don’t have a “comfortable” level of expected production already protected, now might be a good opportunity to further protect from possible lower prices.

Source : ufl.edu