By Don Shurley

Since recent lows at the 66¢ level, prices (new crop December 2025 futures) have now rebounded to the previously established 68.5 to 70¢ range. For the past three months, there has been a level of “resistance” at 70¢ that the market will have to successfully hurdle in order to build the momentum needed to take us even higher.

.png)

The positive move over the past week or more seems due to, at least in part, to a weaker dollar and strong exports numbers. Perhaps there’s also a reality check starting to develop about the impact of reduced US acreage for this year, in light of pre-plant dry growing conditions in some areas.

But any movement up in price also faces some headwinds including trade uncertainties and US and retaliatory tariffs, decline in the US stock market, and possible US recession. So, the market must balance possible reduction in US supply with maybe improving but still uncertain demand.

The USDA monthly supply/demand report for March was mostly a positive one. This also likely contributed to the recent price recovery. Here’s a summary of the major items in the report.

- The US crop and marketing year exports for 2024 were unchanged from February. Ending stocks also unchanged.

- World demand/use for the 2024 crop year increased 590,000 bales.

- World production was increased ½ million bales from the February projection. This was due mostly to increase for China. Australia and Brazil were unchanged.

- Exports for Brazil were increased 200,000 bales. Now 13 million bales for Brazil vs 11 million for the US.

The latest weekly export report (released this week for the previous week ending March 6) was strong. Sales for the week ending March 6 were 284,700 bales. Shipments were 422,700 bales the highest weekly amount thus far for this marketing year. The largest destinations were Vietnam, Pakistan, and Turkey.

It can be assumed, but it is largely undetermined, if increased sales and shipments are perhaps due to the lower level of prices, and if this will continue at improved/higher prices. Shipments are determined by past sales at prices unknown.

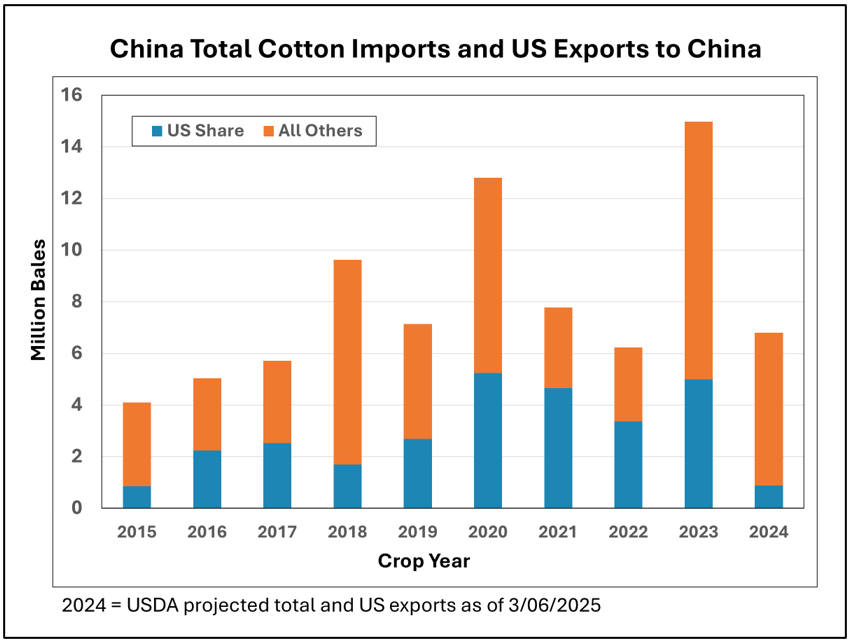

Thus far, China accounts for only 8% of total US export sales. China is projected to import 6.8 million bales this marketing year. Of this total, US export sales to China to date are only 878,000 bales or 13% of their expected total imports. Of course, this can increase as the 2024 marketing year progresses. But currently this would be the lowest exports to China since 2015, and the lowest US percent of their total imports since 2018.

USDA’s Prospective Plantings report of what farmers say they “intend to plant” will be out March 31. The National Cotton Council’s’s estimate released last month was 9.56 million acres down 14.5%. The USDA Outlook Forum projection is 10 million acres. Prices are not likely to react upward unless the March 31 number is less than 9.5 million acres, and could move down on a number over 10 million.

Source : ufl.edu