By James Mitchell and Ryan Loy

The decision to rebuild the U.S. cowherd is based on profitability—not just current prices.

According to the Livestock Marketing Information Center (LMIC), cow-calf returns in 2023 and 2024 are estimated at $252 and $443 per cow, respectively. At the same time, a common concern among producers is the cost of heifers. For example, USDA-AMS data show 2024 bred heifer prices from the Missouri Show-Me-Select sales averaging over $3,000 per head, a 26 percent increase compared to 2023. Before investing in replacement heifers, whether by buying or raising your own, producers should evaluate the investment over the heifer’s entire productive life on the operation.

Whether you’re spending revenue from calf sales or borrowing, the dollars used today to grow the herd have a cost. Buying bred heifers at $3,000 per head or retaining heifers valued at $1,500/head ties up capital that could be used elsewhere in your business. The key question is: will the future stream of returns from those heifers over their productive life exceed the value of that initial investment today? To answer that, producers can use net present value (NPV), a tool that accounts for both profitability and the time value of money.

To calculate NPV, start by estimating all future revenues from the heifer, primarily from calf sales over her productive life, include her cull value in the last year, and subtract expected annual cow costs to derive future net returns. Next, discount those net returns into today’s dollars using a rate comparable to your loan interest rate or expected return on investment. An 8 percent discount rate is a reasonable starting point. Finally, subtract your initial investment, whether that’s the purchase price or the value of a retained heifer, from the total value of your discounted net returns. A positive NPV suggests the investment will add value to your operation. A negative NPV suggests it does not generate a sufficient return and would not be worth undertaking.

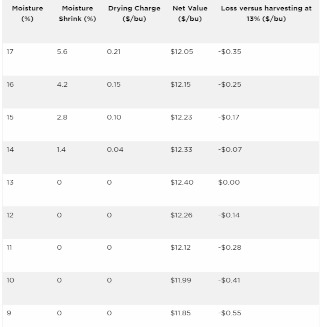

For example, assume you purchase a bred heifer for $3,000 and annual cow costs are $1,000 per year, including pasture, feed, veterinary care, and labor. You expect her to wean a 525-lb calf per year for five years, with calves selling for $295/cwt (or $1,549 per calf). Net returns are $549 per year ($1,549 – $1,000). At the end of year five, you expect to sell her for $1,200, based on 1,200 pounds at $1.00 per pound. To calculate net present value (NPV), we discount each year’s net return and the cull value back to today’s dollars using an 8 percent discount rate:

The total present value is $508.33 + $470.68 + $435.82 + $403.54 + $373.65 + $816.88 = $3,007.79 and the net present value is $3,0079 – $3,000 = $7.79. In this example, the heifer generates a positive NPV over her productive life. However, this NPV is derived under a constant revenue and cost assumption; any unexpected cost or revenue changes can greatly impact the feasibility of this investment due to the small, but positive, NPV value.

There is no single “correct” set of assumptions for this type of analysis. Producers should test a range of scenarios by adjusting calf prices, input costs, reproductive performance, the discount rate, and cull value to reflect their operation. If the investment only appears viable under highly optimistic assumptions, such as a cow producing eight or nine consecutive weaned calves without any setbacks, that should raise concern. The likelihood of that happening is low. If the investment requires everything to go exactly as planned over an extended period just to break even, it may warrant reconsideration. It’s better to identify those risks through planning than to be surprised by them later.

Source : osu.edu