By Don Shurley

I’ve devoted the last 30 years of my life to cotton growers and the cotton industry. Prior to this, I witnessed the 1980’s when financial problems took a toll on many farm businesses. While on faculty at the University of Kentucky, I led an effort working with farmers and lenders to help save some operations. I don’t believe I have ever seen farmers, always the eternal optimists, this disillusioned. Farmers have suffered through 2 to 3 consecutive years of production struggles. Now, on top of that, for the second year in a row, markets are being ripped apart by trade disagreements.

The

Market Facilitation Program (MFP) will help. It may not be enough and may not save some, but it’s a help. Likewise, disaster payments through the Wildfires and Hurricanes Indemnity Program (WHIP) will be a help. It may not be enough, and may not save some, but it’s a help.

For cotton, the way the

Cotton Loan Program works, low prices (when low enough) will generate LDP’s/MLG’s to help insulate the grower. Crop insurance and the farm bill ARC/PLC safety net also help.

Marketing is how you turn your production and hard work into money. Just making a good crop isn’t enough to result in profit. Profit can also be made or lost in marketing. When it comes to prices and marketing, I am convinced we need new thinking and a new approach. I don’t know what the solutions are, but the uncertainty and variability in price is killing the grower and other segments of the industry as well.

Maybe the producers’ tools and strategies already in the tool box (options, hedging, various types of contracts, marketing associations, the Loan, etc.) are enough. Maybe we need to change our approach and philosophy toward risk management. I don’t pretend to know the answers, but something has to change—people are going broke.

USDA released its August estimates this week. Typically, I would take space here to recap the numbers. But, is that really important and useful right now? Probably of only limited importance, but let me mention just a few things that are going to impact the direction prices take from here.

- Expectation for the US crop was raised 520,000 bales from the July estimate due to increased acres planted and higher expected yield. Given the good and improving conditions of the crop, an increase was expected.

- The projection for US exports for the 2019 crop marketing year was increased 200,000 bales. Given the developing weakness in demand and the continued trade war with China, this level of exports and especially to increase it, seems awfully optimistic. Perhaps exports were increased only because of the larger US crop and more available supply?

- World use/demand was cut 1.2 million bales from the July estimate. This is the 3rd consecutive month that use has been cut. Most of the reduction was due to lower use projected for China and India.

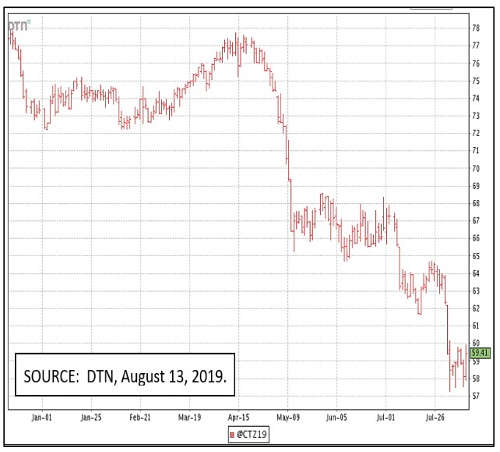

Prices (December futures) have broken and are holding below 60 cents. The price of cotton has dropped 23% over the past 4 months—since mid-April, and even more if we go back to last year. What is a grower to do? You don’t want to sell now and few if anybody is going to. So, the question is, if you’re going to hold and hope for a recovery sometime in the future—how to best play that game?

Reports and news suggest very little of the crop was priced back when the price was much better. Under the circumstances, nothing you do is likely to net you that lost opportunity of 75 cents or better. So in evaluating your marketing choices, growers might need to temper their expectations just a bit for what will be considered “good” should prices begin to trend back up. I truly hope I’m wrong.

With so little of the crop supposedly priced for delivery, merchants should eventually need cotton- especially of good quality. But right now demand is weak and exports uncertain. Price and basis should eventually improve, especially if this trade mess improves.