By Daniel Munch

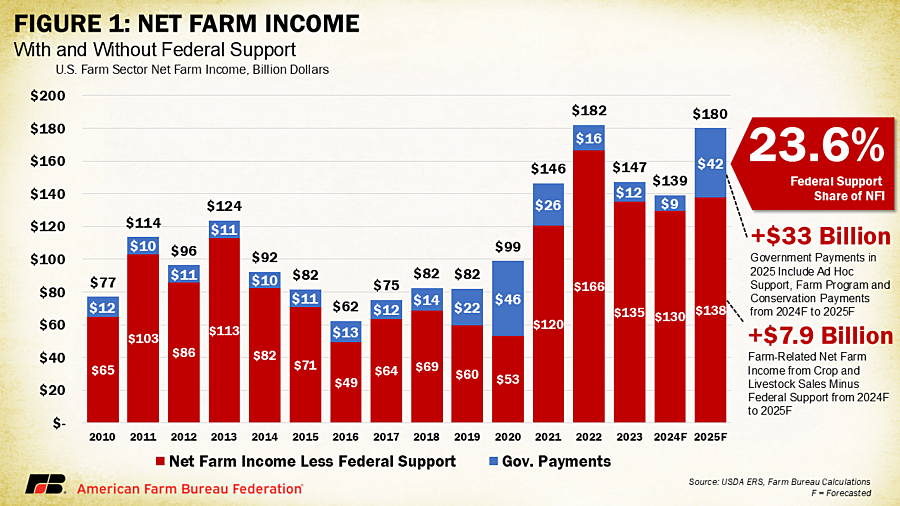

Largely driven by a surge in disaster and economic government assistance, USDA’s latest farm income forecast projects a significant but misleading rebound in net farm income for 2025, rising to $180.1 billion a $41 billion (29.5%) increase over 2024 and following two years of sharp declines. USDA also adjusted its 2024 estimate downward in this update, now projecting net farm income at $139.1 billion, reflecting an $8.2 billion (5.6%) decline from 2023. This is lower than the $140.7 billion (a $6 billion, or 4.1%, decline) forecast in December 2024, showing that farm sector profitability in 2024 was weaker than previously estimated.

The assistance driving farm income projections up was authorized by Congress to offset financial losses farmers and ranchers endured in previous years. However, many producers are still waiting for details on when and how these funds will be distributed, creating additional financial uncertainty as unpaid bills from 2024 continue to pile up. As a result, viewing the 2025 forecast in isolation misrepresents the true health of the farm economy, which will remain challenged in 2025 by generally low commodity prices and widely uncertain market conditions, including the potential fallout from new trade policies such as tariffs that could disrupt key agricultural export markets and increase input costs for U.S. farmers.

When adjusted for inflation, the net farm income increase from 2024 to 2025 is somewhat less dramatic, rising by $37.7 billion (26.4%). If realized, net farm income would be above its 2004-2023 inflation-adjusted average but slightly below record highs set in 2022.

Disaster Assistance Drives Rebound

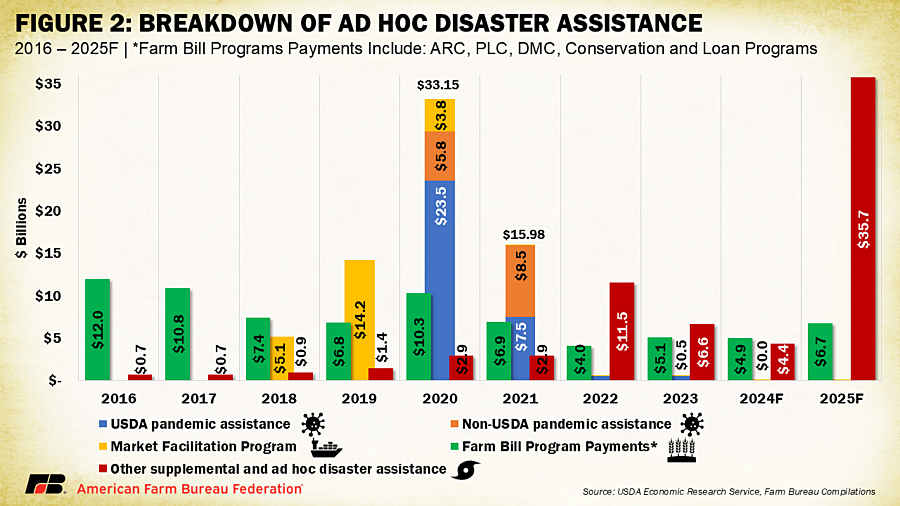

The key driver behind the forecasted increase in 2025 net farm income is the surge in direct government payments, which are expected to reach $42.4 billion a 354.5% increase from 2024’s $9.3 billion. This sharp rise is primarily due to ad hoc disaster relief and economic assistance included in the newly enacted American Relief Act of 2025. The act provides $31 billion in one-time aid, including $21 billion to compensate farmers and ranchers for natural disaster losses sustained in 2023 and 2024, $10 billion to support struggling producers facing economic hardship and $2.5 billion for USDA-administered programs. Please refer to Farmers Head into 2025 with Another Farm Bill Extension, Aid for additional details on the American Relief Act of 2025.

These funds are part of a broader expected increase in ad hoc disaster payments (temporary, emergency payments issued outside standard farm bill programs), which are expected to total $35.7 billion in 2025, up from just $4.35 billion in 2024, a 720% increase.

Traditional farm bill support programs such as Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) are also expected to contribute to the total increase in government payments, though on a much smaller scale. Combined, these payments are projected to rise to approximately $1.6 billion in 2025, more than triple their 2024 levels, but still reflecting the anemic anticipated payout from a 7-year-old farm bill.

While these safety nets provide stability, they do little to mitigate new trade risks. The U.S. has raised tariffs on China while delaying potential tariffs on Canada and Mexico until March, with more under consideration. Farmers fear escalating trade tensions will reduce export demand and drive-up input costs. Between 2018 and 2020, the first Trump administration allocated over $23 billion through the Market Facilitation Program to offset farm losses caused by trade disruptions, highlighting the significant financial impact of past trade conflicts.

This anticipated increase in ARC and PLC payments is primarily due to projected declines in commodity prices. For example, USDA projects the 2025 marketing year average price for corn to be $3.90 per bushel, which is below the effective reference price of $4.26 per bushel. Similarly, sorghum is projected at $3.80 per bushel, under its reference price of $4.51 per bushel. These price forecasts are expected to trigger and therefore increase PLC payments. ARC program payments depend on if actual farm revenue falls below the established revenue guarantee, which is likely given the anticipated price declines.

Conservation payments are also forecast to grow by $663 million (15.1%), from $4.3 billion in 2024 to $5.1 billion in 2025, primarily due to enhanced funding from the Inflation Reduction Act, which boosted conservation programs such as the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP).

Despite these projections, there are numerous reports that Natural Resources Conservation Service (NRCS) conservation project funding has been frozen in response to the Trump administration’s Office of Management and Budget memorandum. This has left producers with signed contracts for conservation work uncertain about when or if they will be reimbursed for conservation projects. If these delays continue, the actual disbursement of conservation funds may fall short of USDA's current forecast.

Dairy Margin Coverage (DMC) payments are projected to decrease by $8.9 million (12%) in 2025 compared to 2024, driven by lower feed costs that are expected to improve milk-feed margins for dairy farmers.

The rise in government payments for 2025 highlights the extent of financial strain caused by recent disasters and declining commodity prices, underscoring the role of ad hoc aid in stabilizing farm income. A new, fully enacted farm bill rather than another extension could have strengthened long-term safety net programs, potentially reducing the need for large-scale emergency appropriations.

Commodity Markets: Mixed Performance Continues

Despite the strong farm income forecast, cash receipts from commodity sales are expected to fall slightly in 2025, declining by $1.8 billion (0.3%) from 2024’s projected $516.8 billion to $515 billion. This marks the third consecutive year of lower cash receipts, largely due to weaker crop markets and reinforcing concerns that any farm income gains are largely government-assistance-driven rather than market-based.

Crop Receipts: Declines Deepen for Key Commodities

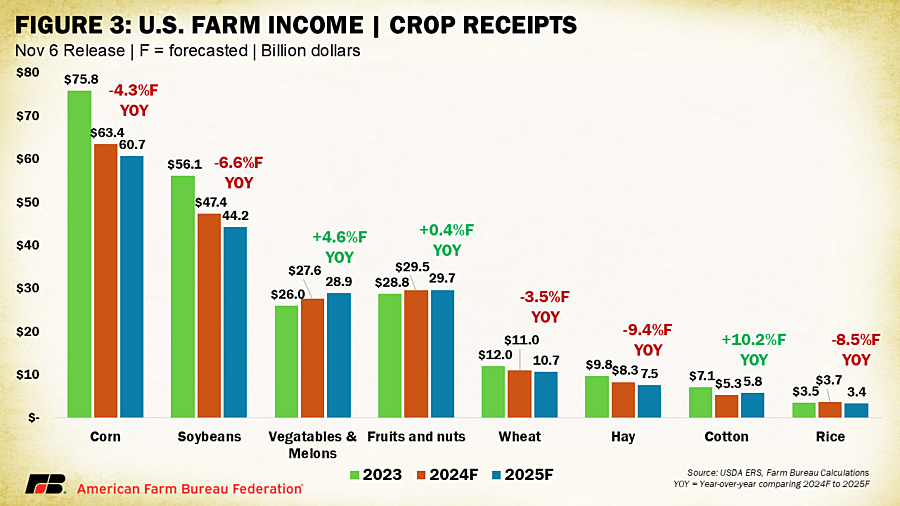

Total crop receipts are forecast to fall by $5.6 billion (2.3%) from 2024’s $245.2 billion to $239.6 billion in 2025, pulled down by declines in major row crops. Corn receipts are expected to drop by $2.7 billion (4.3%) from $63.4 billion in 2024 to $60.7 billion in 2025, with both prices and quantities sold trending downward. Soybeans are projected to see an even sharper decline, falling by $3.1 billion (6.6%) from $47.4 billion in 2024 to $44.2 billion in 2025. Wheat and hay receipts are also expected to shrink, with lower prices playing a key role.

There are a few brighter spots, however. Vegetable and melon receipts are projected to rise by $1.3 billion (4.6%), increasing from $27.6 billion in 2024 to $28.9 billion in 2025, and fruit and nut receipts are expected to see modest gains. Cotton, despite ongoing challenges, is forecast to experience a 10.2% increase in receipts, rising from $5.3 billion in 2024 to $5.8 billion in 2025, due to slightly stronger demand.

Livestock and Dairy: Modest Gains

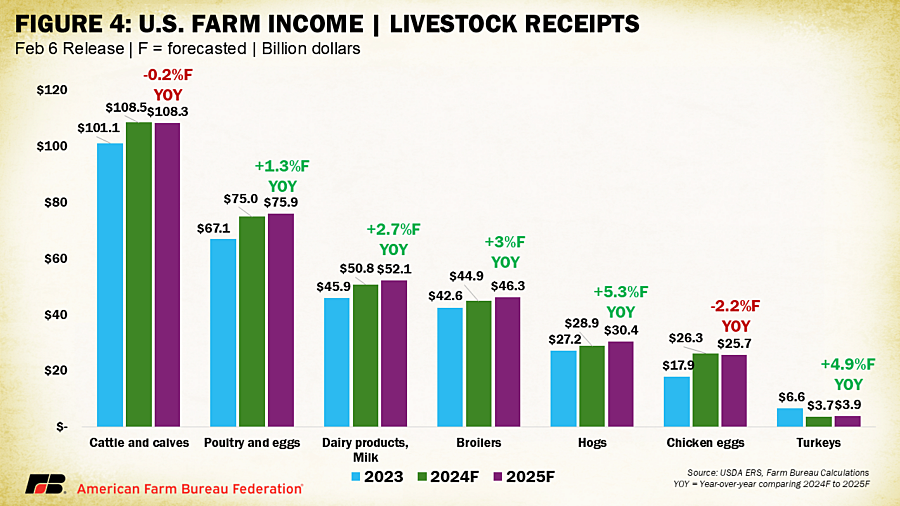

The outlook for livestock and dairy is more positive, with total animal/animal product receipts forecast to rise by $3.8 billion (1.4%) from 2024’s $271.6 billion to $275.4 billion in 2025. Gains in milk, hog and broiler prices are behind this increase, though inflation-adjusted figures suggest a more subdued market.

Milk receipts are projected to rise by $1.4 billion (2.7%), increasing from $50.8 billion in 2024 to $52.1 billion in 2025, supported by stronger prices and increased production. Hog producers are also expected to see a $1.5 billion (5.3%) boost in receipts from $28.9 billion in 2024 to $30.4 billion in 2025. Meanwhile, broiler receipts are forecast to climb by $1.4 billion (3%), from $44.9 billion in 2024 to $46.3 billion in 2025, following a similar pattern of higher prices and quantities sold.

However, not all livestock sectors will see improvements. Cattle and calf receipts are expected to decline slightly from $108.5 billion in 2024 to $108.3 billion in 2025 due to lower sales volumes, and egg producers are forecast to see a $0.6 billion (2.2%) drop in receipts from $26.3 billion in 2024 to $25.7 billion in 2025 due to weaker pricing.

Production Expenses Expected to Decline Slightly

Total farm production expenses, including operator dwelling expenses, are forecast to decline slightly in 2025, falling by $2.5 billion (0.6%) to $450.4 billion. This marks the second consecutive year of expense reductions, following a projected $9 billion (2.0%) decline in 2024. However, despite these decreases, production costs remain historically high, and certain expense categories continue to rise.

Feed expenses the largest single cost category are projected to decline by $7 billion (10.1%) to $62.4 billion in 2025, largely due to lower grain prices. Fertilizer expenses are also expected to fall by $3.6 billion (11.1%) to $29.2 billion, while pesticide costs are forecast to drop by $1.2 billion (6.0%) to $18.1 billion. These declines reflect continued adjustments in input markets following price spikes in 2022 and 2023.

Conversely, labor costs are expected to rise by $1.8 billion (3.6%) to a record $53.1 billion in 2025, driven by wage increases and ongoing labor shortages. Tax and fee expenses are also expected to reach record levels – up 5.7% ($1.01 billion) over 2024. Interest expenses, which have climbed in recent years due to elevated borrowing costs, are expected to decline for the first time since 2020 but only by 0.5% ($135 million) as compared to 2024.

While USDA’s numbers project overall expense reductions, many farmers are deeply concerned that potential tariffs could drive up input costs, particularly for imported fertilizers and equipment. With global trade policies in flux, these projections may not fully account for rising financial pressures on farm operations.

A Cautious Recovery Amid Market Uncertainty

USDA’s latest estimates for 2025 net farm income offer an early glimpse into the farm financial outlook. While the forecast suggests a sharp rebound, much of the projected increase is driven by government disaster assistance rather than improvements in commodity markets. This underscores a more complex reality — one where short-term aid is propping up farm income rather than sustained market-driven growth.

The projected increase in farm income from 2024 to 2025 masks continued price pressures in key crops, declining receipts for some livestock producers, and persistent cost challenges. While disaster assistance provides some short-term relief for previous years’ losses, the 2025 farm economy outlook, especially for field crops, remains weak.

At the same time, the growing uncertainty surrounding trade policies, tariffs and potential supply chain disruptions could significantly impact both farm income and expenses in ways not currently reflected in USDA’s estimates.

As policymakers weigh critical farm bill decisions, USDA’s latest figures underscore the importance of strengthening farm safety net programs in ways that provide predictable, long-term support rather than creating reliance on ad hoc emergency aid. With continued market uncertainty ahead, ensuring a stable and resilient farm economy will require more than a single year of disaster assistance. A strong, fully enacted farm bill could have provided the risk management tools needed to reduce reliance on short-term aid and better position producers against the economic volatility ahead.

Click here to see more...