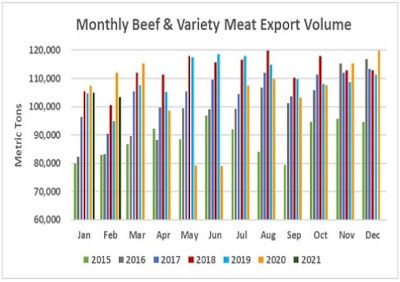

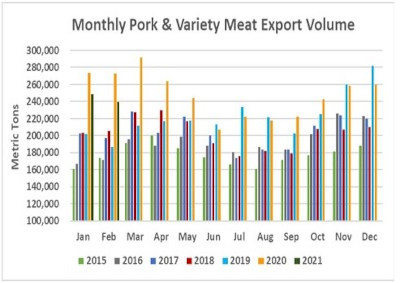

February exports of U.S. beef and pork remained below the rapid pace established in early 2020, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). However, exports were consistent with USMEF’s February projections and the federation still expects 2021 beef exports to increase substantially year-over-year, while pork exports are projected to narrowly surpass the 2020 record. ?

Beef exports totaled 103,493 metric tons (mt) in February, down 8% from a year ago, valued at $669.5 million (down 2%). This was due mainly to a decline in variety meat exports, as beef muscle cuts were steady with last year in value at $597.9 million on a volume of 82,530 mt (down 3%). Through February, beef exports were 5% below last year’s pace at 208,540 mt, valued at $1.32 billion (down 2%). Beef muscle cut exports were down 1% to 163,928 mt and steady in value at $1.18 billion. ?

February pork exports were down 12% from a year ago at 239,240 mt, valued at $629.4 million (down 13%). For muscle cuts only, exports fell by the same percentages to 203,526 mt valued at $548 million. Through February, pork exports were 11% below last year’s pace at 487,896 mt, valued at $1.27 billion (down 13%). Pork muscle cut exports were also down 11% to 411,760 mt, valued at $1.1 billion (down 14%). ?

“While February exports were in line with expectations, the results don’t fully reflect global demand for U.S. red meat,” said Dan Halstrom, USMEF president and CEO. “Logistical challenges, including congestion at some U.S. ports, are still a significant headwind and tight labor supplies at the plant level continue to impact export volumes for certain products – including some variety meat items and labor-intensive muscle cuts.” ?

Halstrom notes that the flow of exports through U.S. ports is showing some gradual improvement as COVID-impacted crews move closer to full strength, but remains a serious concern for the U.S. agricultural sector. ?

“USMEF greatly appreciates the members of Congress and ag industry representatives who have worked to bring more attention to this situation, and the efforts of maritime regulators to address shipping practices,” he said. ?

Export demand has remained solid despite logistical challenges and other pandemic-related obstacles. Continued international demand, along with robust domestic business, contributed to stronger cutout values in the first quarter, which were up an average of 27% year-over-year for pork (nearly $90/cwt) and 4% for Choice beef ($224/cwt).

Strong momentum for beef exports to China, Korea; safeguard impacts Japan

February beef exports equated to $345.37 per head of fed slaughter, up 1% from a year ago. The January-February average was $327.92, up 2%. February exports accounted for 14.4% of total beef production and 12.3% for muscle cuts, down from 15.3% and 12.4%, respectively, last year. The January-February ratios were 13.8% of total production (down from 14.1%) and 11.6% for muscle cuts (up slightly).

The surge in beef exports to China continued in February, reaching 8,644 mt valued at $66 million – far above the minimal levels posted a year ago and making it the fourth largest destination for U.S. beef. Through February, exports were more than 1,000% above last year’s pace in both volume (16,506 mt) and value ($124.1 million). Beef exports to China already exceed the full-year totals reached in 2019, prior to the U.S. securing expanded beef access through the Phase One Economic and Trade Agreement.

February beef exports to South Korea were slightly above last year’s strong totals, pushing January-February exports to 44,892 mt, up 9% from a year ago, while a 10% increase in value ($328 million) established Korea as the value leader for U.S. beef exports in early 2021.

Korea surpassed perennial value leader Japan, where exports felt the impact of an annual import safeguard established in the U.S.-Japan Trade Agreement. While the higher safeguard tariff rate (38.5%) on beef muscle cuts was not triggered until mid-March, importers’ efforts to manage the safeguard likely impacted February shipments, which were 8% below last year at 24,879 mt, valued at $165.1 million (down 4%). Through February, beef exports to Japan were 10% below last year’s pace in volume (46,897 mt) and down 8% in value ($303.1 million).

Japan imposed the higher tariff rate on March 18. It will remain in effect for 30 days, when the rate declines to 25% – the same rate that now applies to beef cuts imported from Japan’s other major suppliers. As prescribed in the trade agreement, trade officials from the U.S. and Japan have begun consultations on possible adjustments to the safeguard.

Other January-February results for U.S. beef exports include:

- While beef exports to most Western Hemisphere markets have trended lower in 2021, demand has strengthened in Central America, continuing the strong rebound seen in the fourth quarter of 2020. Led by growth in Guatemala, Costa Rica, El Salvador, and Nicaragua, exports to the region climbed 8% from a year ago to 3,107 mt, valued at $18.7 million (up 14%).

- Following a record performance last year, beef exports to Taiwan are struggling in early 2021. Through February, exports were down 24% from a year ago to 7,638 mt, with value slipping 15% to $73.4 million. But USMEF-Taiwan reports that demand is strong, with lower volumes more related to shipping delays and the availability of U.S. product. Taiwan still imported more chilled U.S. beef through February, with volume up 3% to 4,250 mt and accounting for 79% of Taiwan’s total chilled imports.

- Beef exports to Mexico were also below last year’s pace, due in part to lower shipments of variety meat. Exports to Mexico trailed last year by 19% in volume (33,734 mt) and 25% in value ($163.1 million).

Pork exports climb to the Philippines and Central America; strong rebound in Colombia

February pork exports equated to $60.34 per head slaughtered, down 11% from a year ago. The January-February average was down 10% to $58.68. February pork exports accounted for 29.4% of total production and 26.9% for muscle cuts, down from nearly 33% and 30%, respectively, a year ago. Through February, exports accounted for 28.6% of total pork production (down from 31.3%) and 26% for muscle cuts (down from 28.6%).

As anticipated, January-February pork exports to China/Hong Kong trended lower than the enormous volumes shipped in 2020 but the region continues to be the largest destination for U.S. pork. China’s efforts to rebuild its domestic swine herd have made progress, but production remains well below pre-African swine fever (ASF) levels and several cases have been reported this year, renewing concerns about disease-related setbacks. Through February, exports to China/Hong Kong fell 25% year-over-year to 147,213 mt, valued at $329.8 million (down 32%). However, exports were 2.7 times larger than in the first two months of 2019.

In the Philippines, where pork production has also been greatly impacted by ASF, exports through February more than doubled last year’s pace in both volume (11,532 mt, up 114%) and value ($28.5 million, up 129%). Prospects for further growth were bolstered this week when President Duterte ordered significant reductions in pork import tariff rates over the coming year. For three months, the in-quota tariff rate of 30% has been cut to 5% and the out-of-quota rate drops from 40% to 15%. For the following nine months, these rates will be 10% and 20%, respectively. Further changes are anticipated in the Philippines that will allow most imported pork to qualify for in-quota rates.

Following a record year in 2020, demand for U.S. pork continues to expand in Central America. February exports were record-large to Guatemala for the second consecutive month and set new highs in El Salvador and Costa Rica, while exports to Honduras were the fourth highest on record. Through February, exports to Central America increased 46% from a year ago to 21,658 mt, valued at $53.3 million (up 38%). While most pork shipped to Central America is used for further processing, the U.S. industry has been successful in expanding U.S. pork’s presence in the region’s retail and foodservice sectors.

Click here to see more...