Five steps to monitoring the financial health of a dairy business.

As the year ends, it’s a good time to assess the financial situation on the dairy farm and set a direction for improvements in the coming year. It has been a challenging year for many dairy producers with low milk prices persisting for nearly two years. Regardless of whether the farm is currently experiencing financial challenges or not, the five-step process outlined in this article should be a regular year-end procedure to identify strengths and weaknesses during any market conditions.

The Five-Step approach was outlined in the "FarmSense" course taught for many years. Dr. Greg Hanson developed the information while working in Penn State’s agricultural economics group. While he appropriately titled the information “Fixing Broken Finances,” it’s important to remember the key to staying out of financial difficulty is regularly applying these steps in all circumstances.

Step 1: Update Financial Statements

Step 1 is updating the financial statements. These include an income statement (with inventory and accrual adjustments) and balance sheets for both the beginning of the year being analyzed (Jan 2016) and the end of the year being analyzed (Dec 2016). All farms can provide the income and expense data required for this process since it is required to file tax reports, but a balance sheet with complete and accurate information is frequently lacking. If the lender regularly requests a balance sheet at year-end, they can share these reports back to the producer. A cash flow plan that looks at the upcoming year’s expected farm performance completes the recommended statements. The Penn State Extension dairy business management group regularly works with farms to help them develop and use these statements.

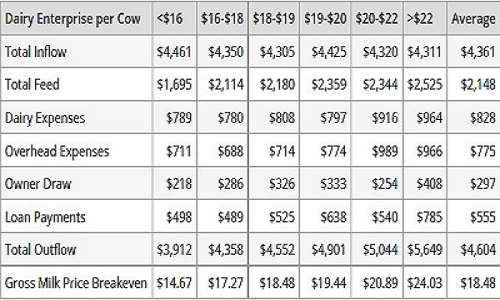

It is helpful for the dairy producer to calculate their historical cost of production. This process requires the user to make corrections to cash expenses for pre-paid expenses and unpaid bills (accounts payable). These corrections are essential to capture an accurate cost of production that reflects “true costs” to produce milk for the year. As Table 1 illustrates, there is wide variation across Pennsylvania dairies in their cost of production with a range from $16/cwt to over $22/cwt. Knowing where your farm falls in this summary provides valuable perspective on the farm’s total financial picture.

Table 1. 2016 projected breakeven milk price ($/cwt) on 104 Pennsylvania dairies. Data presented with farms grouped by breakeven price.

Step 2: Calculate “Farm Financial Standards” Measures

Step 2 includes calculating the “Farm Financial Standards” measures. Whenever possible the producer should examine multiple year trends in these measures to show how the farm has performed over time. A difficult year like 2016 will find many farms challenged on these financial measures. If that’s been true historically, it points to a serious issue. If the farm has historically performed well, a challenging year is discouraging, but not an irrecoverable issue.

Step 3: Prioritize Financial Issues

With the number crunching completed, Step 3 identifies the #1 financial problem. The major categories of financial performance are liquidity (the ability to pay bills on time), solvency (the debt-to-asset ratio and net worth of the business), Efficiency as measured by the sales-to-assets ratio (how hard your investment is working to generate sales), and the profitability of the business as shown by the return on assets ratio. Low profitability in the business over time will ultimately cause a problem in all the other financial aspects of the farm. Getting to the root cause of broken profitability is essential or other financial problems will inevitably follow.

Step 4: Identify Production Problems Linked to Finances

The last two steps relate to the production side of the business. When working with farms on financial problems, the financial consultant is well advised to team up with the best production consultants available. Step 4 says “Identify the production problem linked to the #1 financial problem.” No financial progress ever occurs on a farm without solving production problems first. The big challenge is to correctly identify the problems and to diagnose issues that are by nature complex and intertwined. Not every problem will produce desirable financial consequences, so it’s also important to prioritize the problems correctly to work on the ones that really move the dollars in the right direction.

Step 5: Make Changes!

Finally, after correctly identifying the problems and opportunities, Step 5 is to “Change/adjust the production system.” Every other step in the process can be done to perfection, but if this last one isn’t carried out, the entire process breaks down. Failure at this implementation step will void the best laid plans.

Monitoring and regular checkups throughout the year are needed to assess how the plan is working. To achieve financial improvement this cycle needs to be repeated year after year. The Extension Dairy Business Management team regularly works with producers who want to learn this process. During 2017 a program called Crops to Cow to Cash will be offered where consultants will be trained on the tools and resources available to help producers with this process. In February and March producer workshops will be held to plan 2017 dairy cash flow projections and evaluate strategies for a successful year ahead.

Source: psu.edu