According to the latest Rabobank quarterly pork report, producers’ returns will be challenged by rising costs – including feed, energy, freight, herd health, and labor expenses. Production growth is expected to slow, as is global trade. Consumers’ response remains difficult to gauge, as the impact of higher-cost pork is not yet fully reflected in most markets.

Rising feed and energy costs will pressure producer returns

Producers’ costs continue to escalate in most regions, led by the increase in feed costs. Grain and protein meal costs are higher following a disappointing South American crop and the recent disruption in the Black Sea; and lower global inventories increase commodity volatility. Feed costs vary by region, which provides some advantage to producers with ample local supplies in North America and parts of South America.

Higher energy, freight, herd health, and labor expenses will also weigh on producer returns over the balance of 2022. “The recent spike in energy costs will put additional pressure on an already stressed global supply chain, just as it was emerging from an extended disruption,” says Christine McCracken, Senior Analyst – Animal Protein at Rabobank.

Weaker industry growth is expected

Cost inflation and growing market uncertainty are affecting hog producers’ plans for growth. Disease-related production loss in parts of North America, the EU, and Southeast Asia will weigh on 2H 2022 production growth, limiting global pork availability and helping to boost expected hog prices. Sow herd reductions taken in early 2022 should limit pork production in 2H 2022, with higher-cost feed expected to limit any benefit from higher slaughter weights.

Global trade is expected to slow

Increased global uncertainty due to recent geopolitical conflicts and a shift away from a reliance on trade will weigh on trade flows through 2H 2022, just as slower growth in economically sensitive regions could limit pork imports. “An estimated 11% of annual pork production is destined for global markets, with most export-dependent countries unable to absorb excess pork in local markets. This vulnerability could force some regions to reevaluate their relative exposure to exports and export-led growth,” explains McCracken.

The drop in anticipated export volume is expected to be partially offset by higher pork values, with total trade value expected to near USD 45bn again in 2022.

Consumer response is difficult to predict

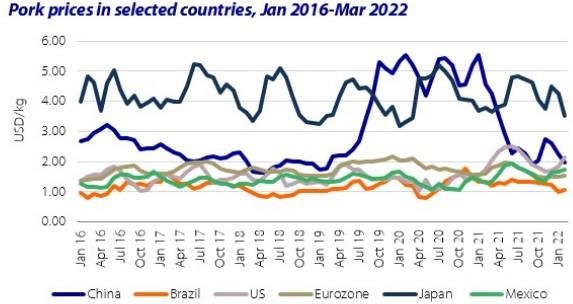

How consumers will respond to higher pork prices is also uncertain. Pork prices do not yet fully reflect the higher underlying cost of production in Europe and some parts of Asia, as the meat supply continues to exceed market needs. “The production response has been muted in most regions thus far but will begin to impact availability beginning in 2H 2022,” according to McCracken.

Efforts to contract the breeding herd, when combined with lower productivity in parts of North America and the EU, will help restore producer profitability, while putting pressure on non-integrated packer-processors. Packers already facing higher operating costs may have some difficulty passing on higher hog costs, given expected consumer weakness. They will focus on optimizing throughput and work to extract additional value from the carcass where possible

Source : Rabobank