By Keith Good

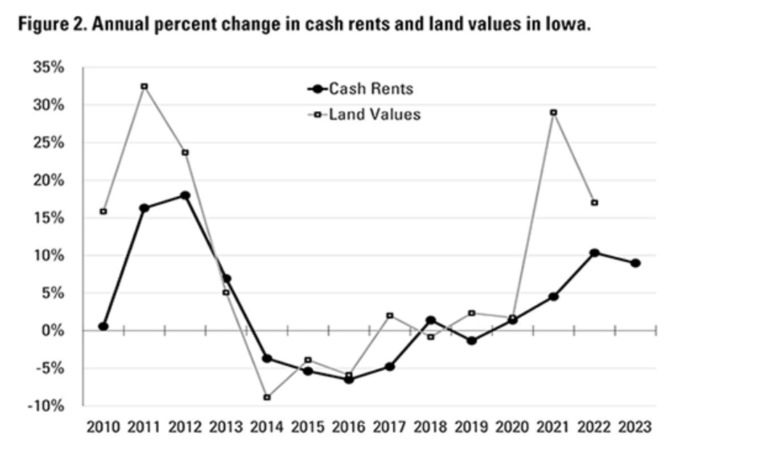

DTN Farm Business Editor Katie Dehlinger reported yesterday that, “The average cash rental rate for Iowa farmland climbed 9% in 2023 to $279 per acre, according to an annual survey conducted by Iowa State University Extension.

“Record high cash rental rates,” by Alejandro Plastina. Ag Decision Maker. Iowa State University Extension (May 2023).

“‘Lower projected crop prices, along with sustained input inflation in 2024 would result in lower net farm income and put downward pressure on cash rents,’ [Iowa State University extension economist Alejandro Plastina] wrote.”

Elsewhere, Reuters writer Michelle Nichols reported yesterday that, “The United Nations is working with the African Export-Import Bank (Afreximbank) to create a platform to help process transactions for Russian exports of grain and fertilizer to Africa, the top U.N. trade official told Reuters on Wednesday.”

“The Black Sea deal was extended last week for the third time after Russia agreed to a further two months. But Moscow has been threatening to quit unless a list of demands to improve its own food and fertilizer exports is met,” the Reuters article said.

And Wall Street Journal writers Amrith Ramkumar and Patrick Thomas reported today that, “Startups that promised to make farming a high-tech business are withering, suffering from rising costs, tight financing, pests and other problems that have troubled traditional agriculture for centuries.

“Investors poured billions of dollars into companies such as AppHarvest and Local Bounti that grow lettuce, tomatoes and other crops in indoor farms that use advanced technology such as sensors and robots to offset weather-related risks, use less water and produce more consistent crops. Shares of the two companies are down more than 95% since they went public in 2021, and in recent months at least four companies in the sector have shut down or filed for bankruptcy.

“Record high cash rental rates,” by Alejandro Plastina. Ag Decision Maker. Iowa State University Extension (May 2023).

“‘Lower projected crop prices, along with sustained input inflation in 2024 would result in lower net farm income and put downward pressure on cash rents,’ [Iowa State University extension economist Alejandro Plastina] wrote.”

Elsewhere, Reuters writer Michelle Nichols reported yesterday that, “The United Nations is working with the African Export-Import Bank (Afreximbank) to create a platform to help process transactions for Russian exports of grain and fertilizer to Africa, the top U.N. trade official told Reuters on Wednesday.”

“The Black Sea deal was extended last week for the third time after Russia agreed to a further two months. But Moscow has been threatening to quit unless a list of demands to improve its own food and fertilizer exports is met,” the Reuters article said.

And Wall Street Journal writers Amrith Ramkumar and Patrick Thomas reported today that, “Startups that promised to make farming a high-tech business are withering, suffering from rising costs, tight financing, pests and other problems that have troubled traditional agriculture for centuries.

“Investors poured billions of dollars into companies such as AppHarvest and Local Bounti that grow lettuce, tomatoes and other crops in indoor farms that use advanced technology such as sensors and robots to offset weather-related risks, use less water and produce more consistent crops. Shares of the two companies are down more than 95% since they went public in 2021, and in recent months at least four companies in the sector have shut down or filed for bankruptcy.

“High-Tech Farm Startups Are Laid Low by Financing Drought, Pests,” by Amrith Ramkumar and Patrick Thomas. The Wall Street Journal Online (May 25, 2023).

“Funding has all but dried up. The industry raised a record $895 million in last year’s first quarter. So far in the current quarter, the figure is about $10 million, according to data provider AgFunder.”

The Journal article added that, “‘Their business model was selling a vegetable, but they somehow described themselves as a technology company,’ said Paul Sellew, chief executive of Little Leaf Farms, a Massachusetts startup that grows lettuce using high-tech greenhouses.

“He says his company has avoided the sector’s difficulties by making day-to-day farming the priority rather than growth. It expects to hit $100 million in sales this year and says it is profitable.

“The struggles of the indoor-agriculture companies mark the latest faltering efforts by entrepreneurs to use technology to upend established industries. WeWork said it was a technology company, not a landlord. That didn’t work. Carvana said it would use technology to reinvent the used-car market. Its shares are down more than 95% from their peak. Katerra was going to reinvent construction. It went bankrupt in 2021.”

Source : illinois.edu