By James Mitchell

Last week’s January Cattle Inventory Report is the most detailed data we will get all year on current and past cattle numbers. Kenny did an excellent job summarizing the report in last week’s Cattle Market Notes. With a week to digest the numbers, there were a few estimates I wanted to revisit.

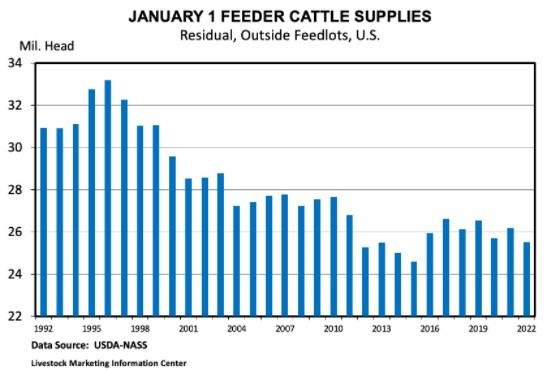

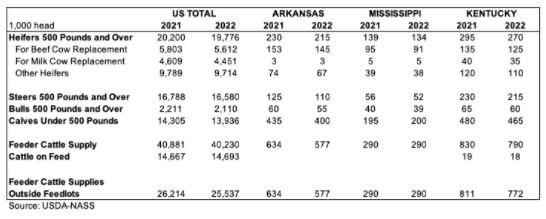

One estimate that analysts like to calculate from the Cattle Inventory Report is feeder cattle supplies outside feedlots as of January 1 (see the first graph above). USDA does not report feeder cattle supplies directly, but it is easy to calculate using other categories in the report. The last row in the table listed below estimates feeder cattle supplies outside feedlots for U.S., Arkansas, Mississippi, and Kentucky, respectively.

Using data from the table, adding Other Heifers, Steers 500 Pounds and Over, and Calves Under 500 Pounds (steers, heifers, and bulls) gives the Total Feeder Cattle Supply. Subtracting Cattle on Feed gives Feeder Cattle Supplies Outside Feedlots. As of January 1, 2022, there were 25.5 million head of feeder cattle outside feedlots, a 2.6 percent decline from last year. Arkansas had a significant decrease in feeder cattle supplies, down 9 percent year over year. In Mississippi, feeder cattle supplies were about even with the year prior, while Kentucky had a 5 percent decline.

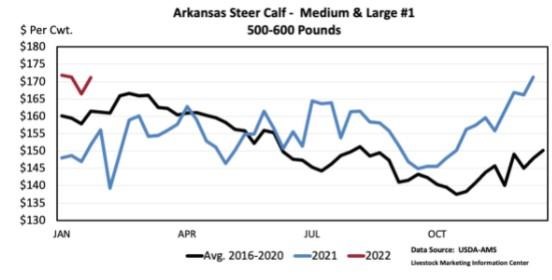

Why did feeder cattle supplies decline so dramatically? Strong fourth-quarter prices, coupled with drought, likely resulted in producers selling cattle that they would have otherwise kept through the winter. For example, Arkansas prices for 500-600 pound steers averaged $163/cwt for Nov-Dec 2021, or 13 percent higher year over year. These high prices provided adequate incentives for producers to sell some cattle earlier. Cattle on feed data showed that cumulative Nov-Dec feedlot placements were 5 percent higher than 2020 placements for the same months.

January cattle on feed inventories are close to even with last year. It will take time for feedlots to work through these inventories. In the next couple of months, we should start to see tighter feeder cattle supplies show up in the placement data. Tighter feeder cattle supplies will translate to higher prices.

The full USDA-NASS report can be accessed here.

Source : osu.edu