By Krista Swanson and Gary Schnitkey et.al

Department of Agricultural and Consumer Economics

University of Illinois

The Biden administration has expressed interest in raising federal estate taxes by lowering the tax-triggering estate value and increasing estate tax rates. Such proposals were included in recent draft legislation entitled “For the 99.5% Act.” This draft legislation focuses on changes to traditional estate taxes and differs from the recently released American Families Plan that proposes changes to income tax brackets, basis determination, and capital gains. Herein, we examine the implication of the “For the 99.5 Act” on farms, assuming present total assets and liabilities determine estate values and estate taxes are calculated at this time. If enacted, nearly 5% more Illinois grain farms would owe federal estate tax. Even more significant is the increased tax burden resulting from the combined impact of changes to traditional estate taxes along with a new tax on property transfers that would also impact farm estates.

Background

The following background is an excerpt from a previous article (farmdoc daily April 6, 2021) with relevant updates based on new information and interpretation.

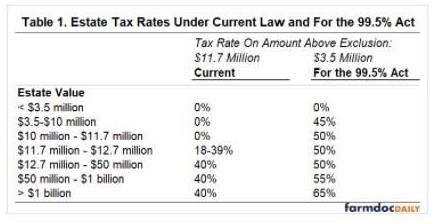

Through the For the 99.5 Percent Act (99.5% Act), bill sponsors Senator Bernie Sanders and Senator Sheldon Whitehouse, seek to reduce wealth inequality by enacting a progressive estate tax on inherited wealth and impose the tax on a larger number of estates (Sanders). The legislation would lower the federal estate tax exemption level from $11.7 million to $3.5 million per individual, resulting in a larger number of estates owing estate tax. The 99.5% Act would also establish a new progressive estate tax rate structure that would tax 45% of the value of an estate from $3.5-$10 million, 50% of the value of an estate between $10-$50 million, 55% of the value of an estate between $50 million-$1 billion, and 65% of the value of an estate over $1 billion (Sanders). These proposed estate tax rates are compared to the current estate tax rates in Table 1.

Importantly, the bill does acknowledge family farmers with expansion of an existing special use provision that allows farmers to lower the value of their farmland by up to $3 million for estate tax purposes, an $1.81 million increase from the current $1.19 million special use level. The proposed legislation also increases the maximum exclusion for conservation easements (Sanders). Though the expansion is beneficial, there will still be farm estates that do not owe estate tax under current law but would under this proposal.

As an example, consider a farm estate owned by an individual valued at $9 million after any applicable deductions. Under the existing $11.7 million exclusion and $1.19 million special use valuation, the estate owes no federal estate tax under current law. Assume the estate is eligible for the full $3 million additional special exclusion for farmland value, reducing the estate value to $6 million. The first $3.5 million is not taxed. The remaining $2.5 million (estate value from $3.5 million to $6 million) is taxed at the 45% rate resulting in $1.125 million estate tax liability under the 99.5% Act proposal.

The legislation would also impact other tax related rules, including those surrounding trusts used to pass wealth, the generation skipping tax, and valuation of assets for estate tax purposes.

Approach to Estimate Tax Impact on Illinois Farms

In this analysis, we estimate the impact of tax code changes proposed in the 99.5% Act on Illinois farms. To evaluate, we analyze Illinois Farm Business Farm Management Association grain farms with at least ten owned acres, using the same dataset as in a similar analysis was conducted for tax changes in the American Families Plan (farmdoc daily May 28, 2021). This evaluation assumes present farm assets less liabilities determine the estate value used to estimate what federal estate tax liability would be at this time under current law and with tax code changes proposed in the 99.5% Act. In reality, estate taxes are only incurred at time of estate transfer.

Following are explanations of the tax code changes considered and calculations used:

Lower Estate Tax Exclusion: Estate tax changes as proposed in the 99.5% Act. This includes a lowering of the exclusion amount – the value at which estates trigger estate taxes – from $11.7 million to $3.5 million per individual (for estates owned by couples, this is doubled) as well as an increase in the estate tax rate owed. We also assume that all farms are eligible for the full special exclusion for the value of farmland up to $1.19 million under current law or $3 million as proposed.

Taxable Estate Value: Several deductions related to the estate settlement may apply in calculating taxable estate value including funeral expenses, executor and trustee fees, and accounting, and attorney fees, among others. These fees could vary greatly, but we assume $50,000 per farm estate. If $0 additional deductions were assumed, results varied little from this assumption indicating overall results would be similar at any level of deductions between $0 and $50,000. In this analysis we assume estate value before the respective estate tax exclusion is present total assets minus total liabilities less $50,000 of deductions when calculating estate tax under both current law and proposed changes. Taxable estate value is the value remaining after respective estate tax exclusions.

Estate Tax Owed: The taxable estate value and the corresponding tax rate under current law and as proposed in the 99.5% Act (see Table 1) are used to calculate the estimated federal estate tax that each farm would owe the estate were being taxed at this time.

Discussion of Results

Federal estate taxes currently impact a very small portion of U.S. farms. According to the United States Department of Agriculture, 99.4% of principal operator farm estates were not even required to file an federal estate-tax return in 2020 and only 0.16% of principal farm operator estates owed estate taxes (USDA).

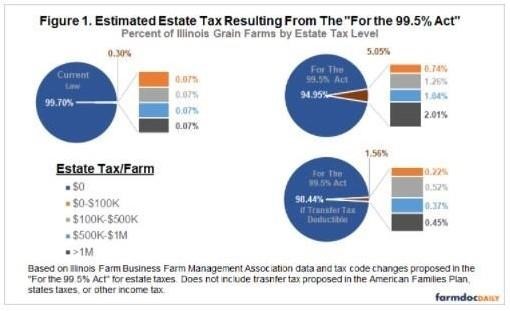

The FBFM dataset shows 0.3% of Illinois grain farms owning at least 10 acres would owe estate taxes under current law if all farms were being passed in an estate now. This is very close to the rate USDA reports. A slightly larger share of Illinois grain farms subject to estate tax likely revolves around underlying value of farm property in Illinois compared to the national level. In 2020, NASS shows the average farmland value in Illinois was $7,300, nearly 80% higher than the average United States farmland value of $4,100. Also, FBFM farms are largely full-time commercial farms with fewer small or hobby farms than included in USDA numbers.

If all farm estates (based on present values of farm assets and liabilities) were passed and incurring federal estate tax at this time, the percent of Illinois farms owing federal estate tax would increase from 0.3% under current law to 5.1% with the proposed changes to federal estate tax exclusion levels and rates. The average federal estate tax that would be owed would increase from $1,628 per farm under current law to $58,311 with proposed changes. Although estate tax is calculated on the value of the full estate, we present estate tax per owned acre to provide context for the estate value relative to farm size. Average federal estate tax per owned acre would increase from $333 under current law to $1,813 under the proposed law. Assuming all present farms were passed in an estate now, the share of farm estates owing tax in at each level increases under the proposed legislation (Figure 1, top left). Under proposed legislation in the 99.5% Act, the percent of farm estates owing tax increases at each level but the largest increase is in the over $1 million level (Figure 1, top right compared to top left).

Separately, the American Families Plan introduces a new transfer tax that would apply to all property transfers, including transfers of property at death (farmdoc daily May 28, 2021). Though it applies to property transfers at death, it is calculated separate from estate taxes. At this time, it is unclear if the transfer tax will be deductible on the estate value. If the transfer tax paid is not deductible on the estate value and 99.5% Act estate tax changes were also enacted, there would be significant increases in total tax liability incurred for farms at death when considering the tax on the property transfer at death in addition to traditional estate taxes.

If the transfer tax is deductible on the estate value and the 99.5% Act is enacted, 1.6% of Illinois farms would owe federal estate tax and the average estate tax owed would be $11,446. The allowance for deduction of the transfer tax would reduce the number of farms affected by the 99.5% Act in terms of owing traditional estate tax (Figure 1, bottom right compared to top right), though not reducing below current levels (Figure 1, bottom right compared to top left). Plus, the farm would still incur the transfer tax liability. Approximately 50-70% of Illinois grain farms would incur a tax liability on transfer of property at death (farmdoc daily May 28, 2021). Though the transfer tax can be deferred as long as the farm is owned and operated, the tax burden remains. All of the farms that would owe transfer tax at death – whether owing traditional estate tax or not – would have an increase in total tax liability related to the estate and property transfer when considering the combined impact of the new transfer tax plus traditional federal estate tax.

Summary

The 99.5% Act would increase federal estate taxes for Illinois farms. With the assumption that present total assets and liabilities would determine estate values and estate tax liabilities are calculated now, nearly 5% more Illinois grain farms would owe federal estate tax and the share of farms owing more than $1 million grows.

Actual farm estate values will depend on total assets and liabilities at the time of transfer at death and could vary from present values. The estate tax liability is not actually incurred until the time the estate is passed to an heir.

Separately, the American Families Plan introduces a new transfer tax that would apply to all property transfers, including transfers at death. At this time, it is unclear if the transfer tax will be deductible on the estate value. Though the ability to deduct transfer tax would reduce the number of farm estates incurring a traditional estate tax, those farms would still owe transfer tax and the combined impact of the new transfer tax plus traditional federal estate tax would result in an increased tax burden for the approximately 50-70% of Illinois farms impacted.

This analysis provides an estimate of how Illinois grain farms would be impacted considering federal estate tax only. It does not include dollar values for the transfer tax proposed in the American Families Plan, states taxes, or other income tax.

Source : illinois.edu