By Silvina Cabrini and Joana Colussi

Argentina is a key player in the global corn market, ranking fifth in production and third in exports. Approximately 20% of the corn traded globally is produced in Argentina, accounting for nearly 5% of global corn production. After a very poor 2023 harvest under a third consecutive La Niña (see farmdoc daily, March 31, 2023), initial projections suggested a record corn harvest in Argentina for the 2023/2024 crop (hereafter referred to as 2024). However, the latest estimates show a sharp decline in expected production due to the presence of corn stunt disease. This article examines how this disease has recently impacted corn production in Argentina and explores the outlook for the upcoming crop season, given that this issue has reached the main production areas and potentially could persist.

From Record Hopes to Disease-Induced Decline

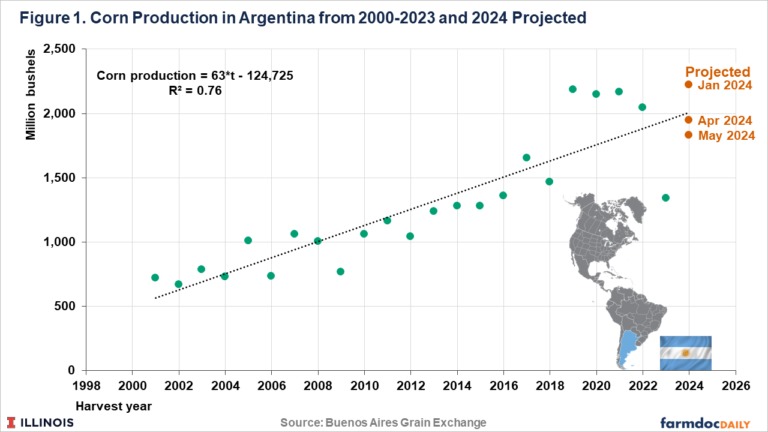

Initial expectations for 2024 predicted a record corn harvest for Argentina, driven by an increase in both planted area and yield (Figure 1). However, the latest estimates from the Local Commodity Exchanges and the Argentine Secretary of Bioeconomy indicate a significant decline in expected production (see Figure 1). The primary factor for this decline is the increased presence of corn stunt disease. Argentina’s corn sector is facing an unusual situation where a non-weather factor is having a substantial negative impact on crop production.

On May 23, 2024, with 30% of the area harvested, the Buenos Aires Grain Exchange reported an expected production of 1,830 million bushels, 20% lower than the 2,224 million bushels anticipated earlier in the growing season (Figure 1). Other private and public sources of grain market information report similar declines in expected corn production.

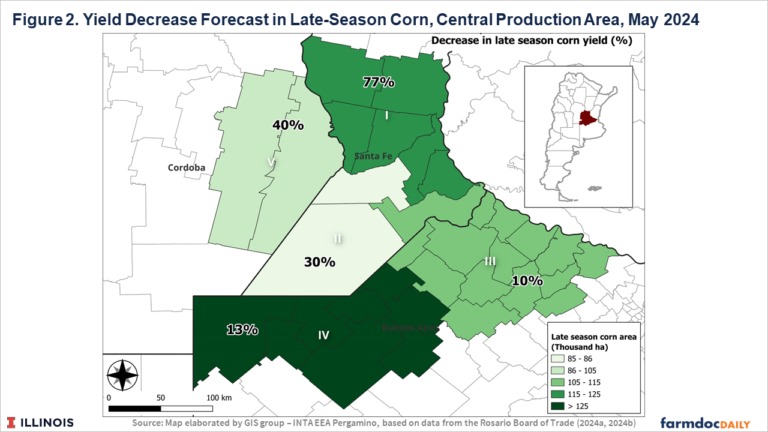

The impact of corn stunt disease varies by region and planting time. In areas with staggered corn plantings, late-season corn suffered the most from the disease. Symptoms were recorded in almost all late-season fields planted in December. In several cases, disease losses have reached 100%, while in others, the loss was as low as 5%.

Several loss maps have been published for different production areas. The Rosario Board of Trade (2024a, 2024b) reported a map detailing average losses in late-season corn in the central agricultural area (Figure 2). This area represents approximately 15% of Argentine corn production, with 35% being late-season corn fields. Additionally, the Secretary of Bioeconomy shows regions of up to 1,483 million acres with a 60% yield loss in the northern part of the country.

What is Corn Stunt and What is This Year’s Impact?

Corn stunt disease involves several pathogens: Spiroplasma kunkelii, Maize fine-striped virus, Maize bushy stunt phytoplasma, and the Geminivirus maize striate mosaic virus. They are all transmitted by the same maize-specific vector, the leafhopper Dalbulus maidis (Secretary of Bioeconomy Argentina, 2024). Depending on the stage of the maize plant’s growth cycle when infected, various economic impacts exist (Figure 3).

In previous crop years, corn stunt has been present in the country’s northern region. However, the current 2024 crop season marks the first time this pathology has challenged Argentina’s central corn production region. Several factors are associated with an increase in the presence of the vector in the current crop season, such as:

- A higher degree of staggered planting dates, with a higher proportion of late-season corn. This trend towards later planted (December) corn acreage is explained as a strategy to mitigate the effects of droughts since there is a lower likelihood of late season corn being exposed to water stress during flowering.

- A decrease in the occurrence of frosts during the last winters since low temperatures and frosts decrease the presence of Dalbulus maidis.

- Poor control of host plants, mainly volunteer corn. These plants are crucial for completing the green bridge for the leafhopper vector agent. The increase in the presence of voluntary corn is due to herbicide resistance and milder winters.

What is Expected for the Upcoming Crop Season?

The recommendations that the public sector and producer associations have developed include guidelines for corn growers (Secretary of Bioeconomy, 2024; Argentine Seed Association, 2024). The recommendations include:

- Planting less susceptible hybrids. While information on the behavior of corn hybrids is scarce, it is presumed that most hybrids used in temperate zones are highly vulnerable to the corn stunt disease complex.

- Control of host plants, particularly volunteer corn is key. Strategies include implementing a 90-day sanitary vacuum to prevent the survival of the leafhopper and avoidance of staggered plantings.

- Suggestions to consider insecticide applications in maize at early vegetative stages. While there are currently no registered products in Argentina for corn stunt vector control, there are several products in the experimental stage.

In addition, producer associations have requested a reduction in export taxes on corn as a way to partially compensate producers for the economic losses caused by this disease complex. While most countries encourage exports, in Argentina, they are taxed. The value of soy exports (bean, oil, and flour) are taxed at 33%, while wheat, corn, and meat exports pay 12%.

Final Considerations

The emergence of corn stunt disease has dashed the expectations of a record corn crop in Argentina in 2024, leading to a substantial decrease in anticipated production. In this scenario of uncertainty, the public information generated by state agencies such as the National Institute of Agricultural Technology (INTA), the National Service for Agri-Food Health and Quality (SENASA), and the Secretary of Bioeconomy is crucial. There is an urgent need for information related to hybrid behavior against the disease, monitoring of the population dynamics of the vector, and the effectiveness of chemical controls for this insect.

The reduction in corn production would not imply the possibility of importing corn in Argentina, but it would mean a decrease in exportable volumes compared to the estimates at the beginning of the season. Therefore, this could create more demand for corn from the United States and Brazil, the main global exporters (see farmdoc daily, March 12, 2024), in areas where Argentina would otherwise export.

While it is still too early to estimate planting intentions for the next season, there are reports of a growing interest in planting sorghum and wheat as alternatives to corn to diversify crop sequences. This disease complex poses a challenge that requires coordination between the public and private sectors to find robust solutions for adapting corn production systems in Argentina.

World corn prices depend on many factors affecting supply and demand for the leading players in this market, including the United States, Brazil, Argentina, and Ukraine. Reducing corn yield and planting area in the incoming seasons for Argentina can be a factor for higher prices in the international market.

Source : illinois.edu