By Jana Rose Schleis

The ongoing tariff battle between the U.S. and its three largest agricultural trading partners is worrying Midwestern farmers.

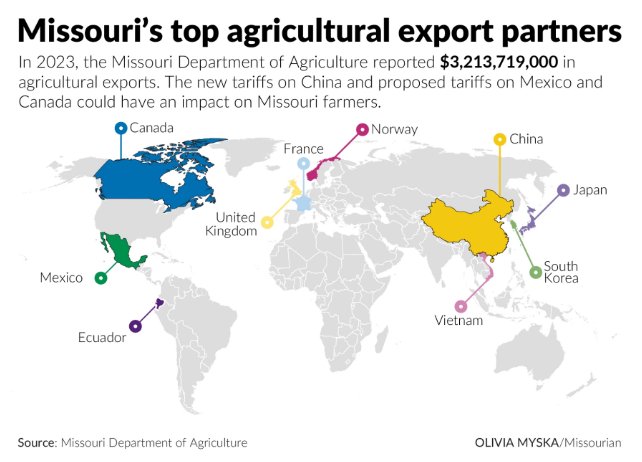

President Donald Trump imposed an additional 10% tariffs on all imports from China. Soon after, China retaliated with tariffs on U.S. products. Trump also proposed 25% tariffs on imports from Canada and Mexico — which have been paused for 30 days.

The president said he’s using the tariffs to force Canada and Mexico to increase border security. In a statement from the White House, the Trump administration said previous presidents “failed to fully leverage America’s economic position as a tool to secure our borders against illegal migration and combat the scourge of fentanyl.”

Bryant Kagay grows corn, soybeans and raises cattle in northwest Missouri. He believes tariffs should be narrowly targeted and used sparingly. He said he fears the recent tariffs could hurt farmers.

“It just seems like a very heavy handed approach towards negotiation, and I just fear it will impact our ability to have future trade negotiations with some of these countries,” Kagay said.

Kagay said ideally, tariffs would be used as a tool to enforce best trade practices, not as a tactic in immigration negotiations.

“The idea that we can use tariffs as a bargaining chip or leverage to get concessions that are really unrelated to the products and industries most affected by the tariffs. I can't say I'm really comfortable using them that way,” he said.

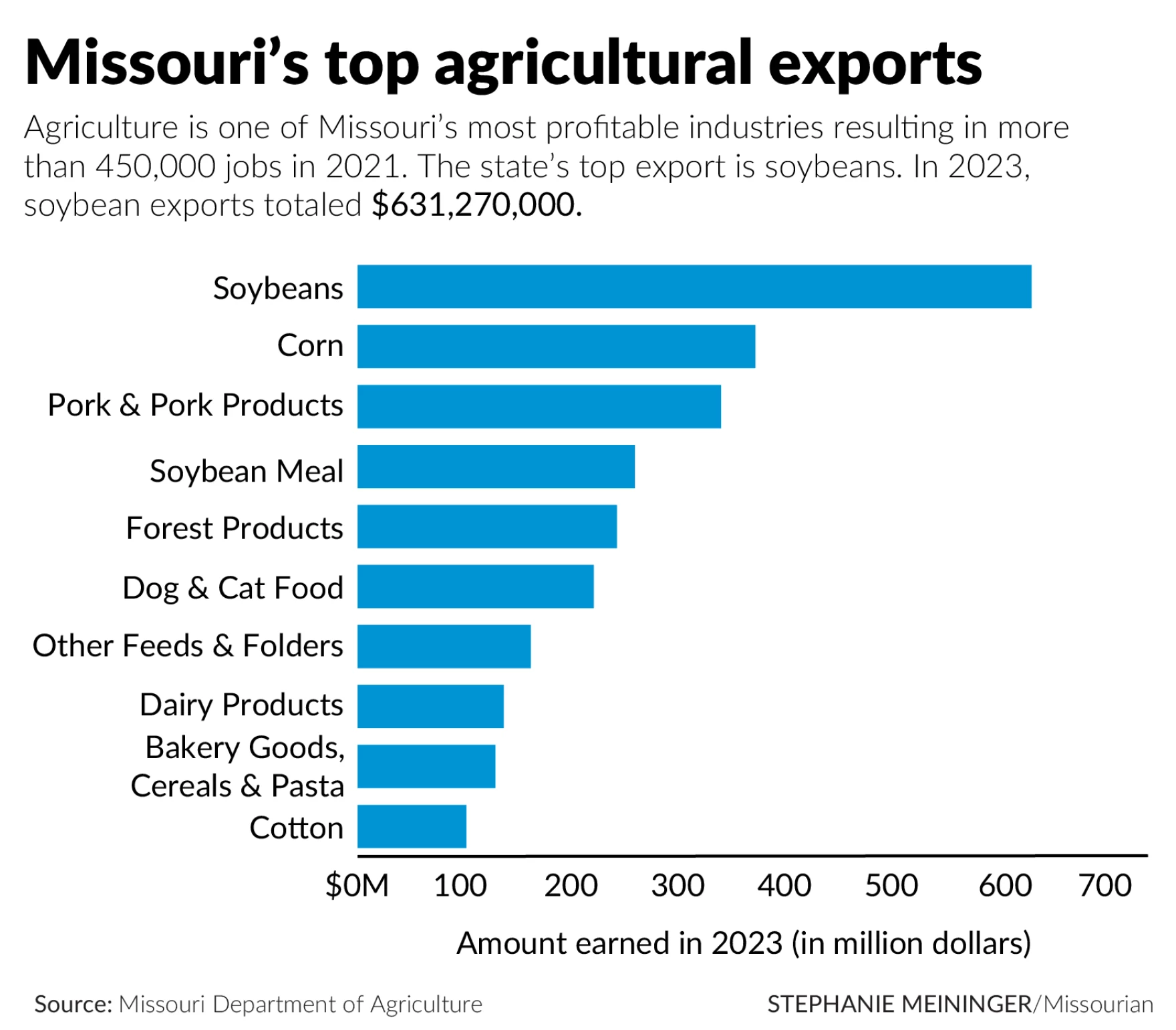

According to the Missouri Department of Agriculture, the top agricultural exports from the state are soybeans, corn, pork and soybean meal. The state’s top agriculture export partners include China, Mexico and Canada — as well as some countries in Europe and Southeast Asia.

Approximately 16.2% of U.S. corn is exported, much of that going to Mexico. A larger share of the country’s corn crop is used domestically for livestock feed and ethanol production.

Ben Brown is an agriculture economist with MU Extension and specializes in row crop policy and farm finance. He said about 86% of U.S. cotton is exported, as well as 50-60% of grain sorghum, and approximately 45% of U.S. soybeans — with about half of that going to the Chinese market.

“It wasn't that long ago that one out of every three rows of soybeans grown here in the United States was going to China,” he said. “Today, it's probably more like one out of every four rows goes to China … still relatively large.”

American Farm Bureau President Zippy Duvall was alarmed when Trump announced tariffs on Canada, Mexico and China.

“Farm Bureau members support the goals of security and ensuring fair trade with our North American neighbors and China, but, unfortunately, we know from experience that farmers and rural communities will bear the brunt of retaliation,” Duvall said in a news release.

Duvall said the announced and proposed tariffs put farmers in a “tough spot.”

“More than 20% of U.S. farm income comes from exports, which are dominated by these three markets,” he said. “Just last year, the U.S. exported over $30 billion in agricultural products to Mexico, $29 billion to Canada and $26 billion to China — our top three markets and nearly half of all exports by value combined.”

In a letter to the White House, the American Farm Bureau urged caution.

“We ask that you carefully consider the impact on American farmers and ranchers, associated businesses and rural communities when determining potential trade actions,” the letter stated.

The National Farmers Union, another group representing agriculture producers across the country, similarly asked the president to reconsider tariffs due to the economic impacts on farmers.

“The position that the Farmers Union has is pretty much identical to the position that the Farm Bureau has on tariffs,” said Richard Oswald, vice president of the Missouri Farmers Union. “It's just not a good idea.”

Oswald farms in northwest Missouri with his family, growing corn and soybeans while his children raise livestock. He’s especially concerned about what retaliatory tariffs could mean for corn and soybean markets.

“We just don't utilize those soybeans at home,” he said. “If we don't sell them, we have nothing to do with them.”

Oswald said his farm is trying to reign in spending as much as possible given the unknown impacts tariffs may have on farm budgets this crop year, but, he said, there’s only so much that can be done.

“If we're going to produce a crop we still got to buy fertilizer, and we still got to buy seed, we still got to buy fuel, and that’s pretty hard to pare that back,” Oswald said.

Brown said tariffs can “play both ways” — meaning tariffs on U.S. products have the ability to disrupt the marketplace and it can take time for farmers to find new buyers. Tariffs on imports can make international goods more expensive for domestic consumers, potentially making a domestic version of the product more attractive, if it’s available.

“I will say that it's more complex than just saying that tariffs are bad for U.S. agriculture,” said Brown. “They're bad for products that we export to other destinations around the world.”

Tariffs increase the unknowns in an already somewhat volatile industry. Brown said commodity prices have been up and down throughout the month of January.

While yields for Midwestern staples like corn and soybeans have increased over the past two decades, so have the costs of the fertilizers, pesticides, fuel and equipment required to cultivate the crops. Brown said the 2023 crop was the most expensive ever in Missouri.

Fertilizer, ethanol spared for now

After the Trump administration announced tariffs on Canada and Mexico, each country retaliated with tariffs on U.S. products. The Canadian government is proposing 25% tariffs on $30 billion in goods the country imports from the United States. The implementation of those tariffs has been delayed while the countries’ leaders negotiate.

Brown said the agriculture industry was spared when Canada chose not to tax U.S.-produced ethanol.

“I think the U.S. corn industry breathed a little sigh of relief because they are our largest international buyer of ethanol, and ethanol was not included in that list,” he said.

Similarly, Canadian exports of potash — a fertilizer used in soybean production — was spared from the United States tariff list.

“There was a lot of concern from U.S. producers leading up to a potential implementation (of tariffs), that potash and fertilizer prices could increase drastically, just based on how much fertilizer and potash we get from Canada,” Brown said.

Click here to see more...