By Bradley Zwilling

Introduction

The Tax Cuts and Jobs Act (TCJA) of 2017 brought many changes to how farmers handle depreciation. This Act raised the Internal Revenue Service (IRS) Code Section 179 expense election (EE) to $1 million and the expense election phaseout to $2.5 million adjusted for inflation. In addition, bonus depreciation increased to 100% of the purchase price. In addition, like-kind exchanges are now limited to real property. Since machinery values have continued to increase, this article will look at the impacts on the net taxable income at various levels when using the expense election and bonus depreciation.

Key Depreciation Rules

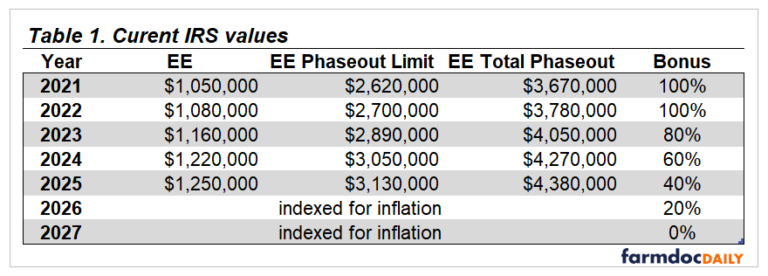

Table 1 shows the annual limits set by IRS that farmers can utilize in the first year of a farm asset under code Section 179 expense election and bonus depreciation.

- Expense Election (EE): Allows individuals to deduct a set amount of qualified purchases immediately, provided total qualified purchases remain below the phaseout limit.

- Phaseout Limit: Once the total value of purchases exceeds a certain threshold, EE deductions are reduced dollar-for-dollar until fully phased out.

- Bonus Depreciation: Allows additional deductions on qualified purchases based on a set percentage. If elected, all assets with the same life have to use this deduction. Unlike EE, it can create a net operating loss.

- Modified Accelerated Cost Recover System (MACRS): Farmers use this method for 200% declining balance on items that EE and bonus are not used to determine first-year regular depreciation. For 5 year property, that is twenty percent.

Examples of Depreciation Impact

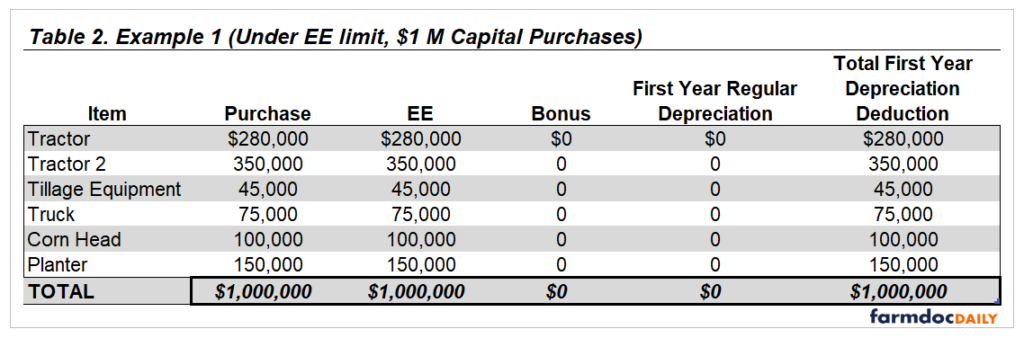

Assumptions: The farmer has earned income equal to the EE amount. In addition, the assets are assumed to be new and qualified purchases. When there is still a basis remaining (after taking the full amount of EE and bonus), the balance is depreciated using MACRS 200% declining balance, half-year convention with a 5-year life. All assets are acquired by trade. The assumed value of those assets traded in are 80% of the asset’s value acquired.

Example 1

Table 2 shows purchases of farm assets totaling $1 million which qualifies for the full EE deduction, and no bonus depreciation is needed. The current net taxable impact for Example 1 is negative $200,000 ($800,000 sale of traded assets minus $1 million first year depreciation deduction). A negative amount would mean there would be a deduction in the current year of $200,000.

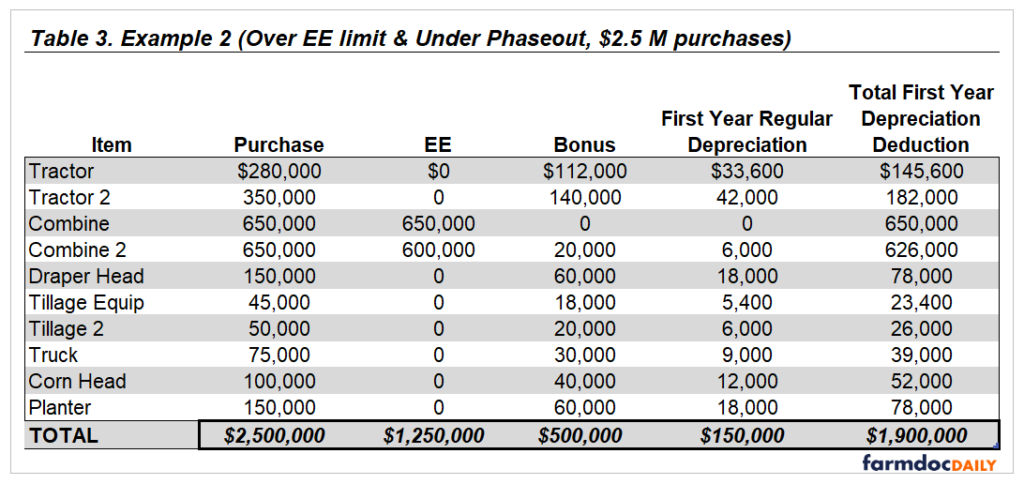

Example 2

Table 3 has farm asset purchases of $2.5 million which exceeds the EE maximum limit, but below the phaseout limit. The first $1.25 million qualifies for EE, while 40% of the remaining purchases qualify for bonus depreciation. The rest is depreciated using MACRS 200%. The current net taxable impact for Example 2 is $100,000 ($2 million sale of traded assets minus $1.9 million first year depreciation deduction). This means that even though they spent $500,000 (trade difference), the first-year taxable income would increase $100,000. However, the remaining balance of the purchase price will come as a deduction using MACRS depreciation over five years which will offset principal payments on any financed purchases.

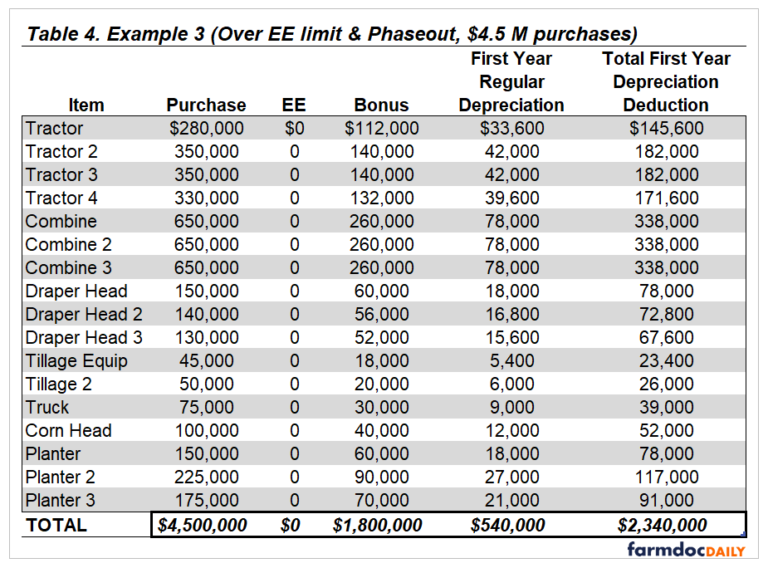

Example 3

Table 4 has $4.5 million of farm asset purchases which is over the 2025 EE total phaseout limit. However, 40% of the purchase price qualifies for bonus depreciation. The rest is depreciated using MACRS 200%. The current net taxable impact for Example 3 is $1.26 million ($3.6 million sale of traded assets minus $2.34 million first year depreciation deduction). This means that even though they spent $900,000 (trade difference), the first-year taxable income would increase $1.26 million. However, the remaining balance of the purchase price will come as a deduction using MACRS depreciation over five years.

Key Takeaways for 2025

- If purchases are under $1.25 million, EE allows full deduction.

- Purchases between $1.25 million and $3.13 million benefit from a mix of EE full deduction, bonus and regular depreciation.

- Purchases between $3.13 million and $4.38 million benefit from a mix of EE phasing out, bonus and regular depreciation.

- Purchases over $4.38 million receive only bonus depreciation and regular depreciation.

- Current taxable income in year of purchase can increase once purchases are over $3.13. However, the remaining deduction will come over the life of the loan if financed, allowing for a deduction against a non-deductible principal payment.

- As bonus depreciation phases out, tax planning becomes critical.

Conclusion

As farms continue to get large and the value of farm machinery increases as well, the impacts on first year depreciation become larger. Many times, farmers trade in equipment to purchase new equipment, and the financial outlay is the difference between the two values. However, since the full amount of the trade values shows as a sale on the tax return, careful planning is needed to understand the impact on the tax return because in some situations such as examples two and three, taxable income can go up in the year of purchase even though there was a cash outlay to purchase the new assets. This is due to at minimum only 60% (40% bonus and 20% first year MACRS deprecation) can be taken as a current year depreciation deduction. Since EE limits and bonus depreciation change over time and vary among states, farmers must plan purchases carefully to optimize tax benefits and achieve their financial goals. Consulting a tax professional can help navigate these rules to help understand the impact on your farming operation.

Source : illinois.edu