By Joe Janzen

Department of Agricultural and Consumer Economics

University of Illinois

On Wednesday, November 9, the USDA released its latest World Agricultural Supply and Demand Estimates, or WASDE. The WASDE report provides an updated point of reference for agricultural commodity price expectations. This article discusses changes made by USDA to its 2022/23 corn and soybean balance sheets. Grain and oilseed markets certainly do not hold to the old saying that “no news is good news”. Rather, limited changes in the balance sheet mean small changes in price expectations as was the case last week. This article also discusses one thing to watch going forward: global macroeconomic uncertainty and signs of weakening corn and soybean demand in international data.

Latest US Corn and Soybean Supply and Demand Estimates

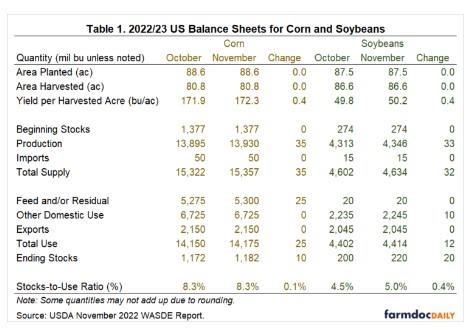

USDA made only slight changes to the 2022/23 US corn and soybean balance sheets in the November WASDE report. Yield for both crops increased by 0.4 bushels per acre. This continues a sequence of ever-smaller yield revisions that began with the August report, as USDA homes in on a final yield estimate forthcoming in January. Past experience suggests further changes to estimated yields are likely to be small (see farmdoc daily July 18, 2022).

Higher production was to some extent offset by increases in projected domestic use. Corn feed and residual use increased 25 million bushels and domestic soybean crush increased 10 million bushels. The remainder of increased production was allocated to projected ending stocks. The net result of these modest changes was a slight increase in the overall supply and demand balance. The ending-stocks-to-use ratio rose about 0.1% to 8.3% for corn and 0.4% to 5.0% for soybeans. Both levels are historically tight. But with little change since the October report, price reaction was muted. On the report day, December corn futures fell 3 cents per bushel and January soybean futures rose 5.5 cents per bushel.

Probably the most notable part of an otherwise unremarkable report were unchanged US corn and soybean export projections. US grain exports face headwinds as low water levels on the Mississippi River impede barge traffic (farmdoc daily November 2, 2022). The pace of export sales and inspections is slow (see Brownfield Ag News November 14, 2022). It remains to be seen how much of this sluggishness in export demand measures can be offset by more rapid progress later in the marketing year if river levels rise and transportation bottlenecks ease.

Macroeconomic Uncertainty and the Corn and Soybean Markets

Recent economic headlines highlight considerable uncertainty for the global macroeconomy. Some of these stories, like the ongoing meltdown in cryptocurrency markets, may have little bearing on agricultural prices. Others like China’s choice to pursue social stability rather than economic growth through its ‘zero-covid’ strategy (VOA October 17, 2022) or widespread layoffs in the US technology sector (Bloomberg November 14, 2022) may be more relevant to commodity demand.

On a given day, it may be easy to correlate these stories with corn and soybean futures market price changes, but every price change has many possible explanations and ascribing causality to day-to-day price moves is likely fruitless. It is even more dangerous to try to forecast future price changes on the basis of headline news.

To assess whether global macroeconomic conditions are truly impacting agricultural markets, look for corroboration from some measure of quantity found on the US and global balance sheets. In particular, export projections may be a key indicator of changing expectations for global commodity demand. Exports can respond within a marketing year in ways that planted acres, production, or even domestic US demand may not.

The November WASDE report contained a similar ‘no news’ forecast for corn and soybean exports outside the US. Projections for corn exports were identical to the month prior in all countries save for a 0.3 million metric ton drop in exports from South Africa. The soybean export forecast was similarly unchanged, except for a small switch where increased exports from Brazil were offset by similar-sized declines for Argentina. Soybean ending stocks in both Brazil and Argentina were projected lower. This is inconsistent with economic recession affecting commodity demand – yet. To confirm that slowing global economic activity is hitting agricultural markets, look for some combination of declining exports and growing inventories.

Source : illinois.edu