Teucrium ETF Funds Offer Farmers a Risk-Averse Approach

By

Colin McNaughton, Farms.com Risk Management Intern

Moe Agostino, Farms.com Risk Management Chief Commodity Strategist

In the dynamic world of agriculture, where risk management is a crucial aspect of success, a powerful tool has emerged for farmers seeking to navigate the market without delving into the complexities of futures and options trading, its called Teucrium ETF funds.

Perhaps surprisingly, only a small percentage of farmers, ranging from 5-15%, engage in futures/options to manage risk or possess a commodity brokerage account.

The intricacies of these financial instruments often deter farmers for a variety of reasons from a lack of understanding of the various instruments, to time constraints, and the additional layer of management they entail. For those who prefer a more conservative approach and seek a user-friendly method to safeguard their capital, Teucrium ETF funds on soybeans, wheat, or corn might provide a compelling solution.

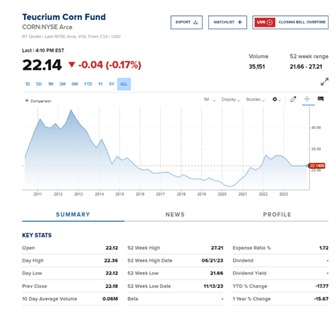

Established in 2010, Teucrium has been a pioneer in offering access to alternative markets through ETFs. The Teucrium Wheat (WEAT), Corn (CORN), and Soybean (SOYB) ETF investments aim to mirror the daily fluctuations in the share price with those of wheat, corn, or soybeans for future delivery, as measured by the Teucrium Wheat, Corn, or Soybean Index.

The fund achieves its objective by investing in respective future contracts, making it an accessible gateway for investors to gain exposure to the prices of these agricultural commodities in a brokerage or investment account.

Consider a scenario where a farmer currently holds a basis in wheat or corn for the December 23 futures. The farmer finds themselves at a juncture, faced with the imminent decision to either flat price the contract or roll it forward, given the persistent disappointment in the futures market.

However, there exists an alternative strategy – the farmer could opt to flat price the basis contract, addressing immediate cash flow needs such as bill payments, while simultaneously replacing 5,000 bushels of wheat or corn with 1,000 shares in the corresponding Teucrium Wheat or Corn Fund.

All Teucrium ETFs are listed on the New York Stock Exchange (NYSE), ensuring transparency and market credibility. While the average expense ratio for these funds is 1.19%, considered relatively high compared to some ETFs, it remains significantly lower than others that charge fees ranging from 3-6%.

Investors can easily track Teucrium ETF funds using the ticker symbols CORN, WEAT, and SOYB. Trading on the NYSE, these funds boast ample liquidity, with substantial assets under management.

Over the years, the assets in Teucrium ETF funds have steadily grown, dispelling concerns about liquidity issues for potential investors. This growth trajectory emphasizes the confidence and trust that investors, including farmers, place in these funds as reliable instruments for managing risk and capitalizing on the potential for higher profits over time.

This is not an endorsement, but rather a sharing of knowledge. This us just one of many possible tools in a farmer’s risk management tool box that farmers should be aware of to help them manage risk. It is always worth the time to explore multiple ways to increase profits and diversify risk.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.