Many producers are probably sitting in fairly good position right now with regard to their cotton marketing and risk management. Provided they took advantage of the opportunities above 70 cents when the market was there—and I think many did.

The question on the mind of most growers is when and if the market will get back above 70 cents and provide an opportunity to add to contract, cash sales, and/or futures Options positions. I believe there are several factors in play that could give growers that opportunity.

Thus far, prices (Dec futures) have, for the most part, managed to stay above support at around 66 to 67 cents. But the market has now also developed a bit of resistance around 70 to 71 cents. So, this 5-cent range seems likely to dominate price activity in the short term unless things change.

USDA’s October supply and demand numbers released earlier this week contained revisions overdue and anticipated by most industry observers. These revisions should be supportive of price.

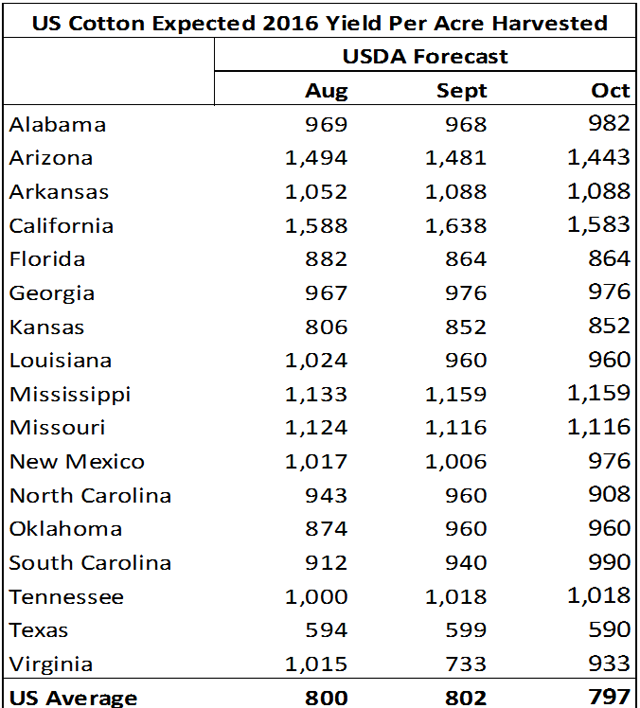

The US crop was lowered just bit based on a slight revision downward in expected yield. The US crop is now forecast at 16.03 million bales—down 110K bales from last month. Yield was revised down in only 5 states but this included Arizona, California, North Carolina, and Texas.

US exports for the 2016 crop year were revised up ½ million bales to 12 million bales. This, along with the slight reduction in the crop, resulted in dropping US ending stocks for the 2016 crop year from 4.9 to 4.3 million bales. This is good news for prices.

In a surprise, at least in the way it came about, World ending stocks projected for the 2016 crop year were lowered almost 2½ million bales or 3%. This too is good news for prices, but it wasn’t due all to higher demand or lower supply for 2016. USDA went all the way back to the 2014 crop year and revised China’s mill use up 1 million bales; then did the same for 2015. So, with a few clicks we all of a sudden have 2 million bales less cotton than we thought we had—at least on paper.

Also in the report, projected World mill use for the 2016 crop year was raised 800K bales. This was accounted for by a 500K bale revision upward in mill use for China. This increase, for China, had been expected due to the extended sales from their government reserve. Revisions upward were also made for Bangladesh and Indonesia.

For the 2016 crop year, there were no changes in the projections for China’s production and imports.

As we now look ahead and consider future price trends, several factors will come into play:

- US export sales have been good. The most recent weekly report was strong and gave prices a boost back above 70 cents today. Since exports to China will likely remain low, any good rate of exports will be especially positive to prices.

- World production will be up this season. But stocks have declined and mill use is showing some fragile signs of improving. To maintain prices near 68 to 70 cents or to move higher, demand must continue to show positive signs.

- IMHO, the US crop is still a big question mark. I believe the US crop could get smaller. Damage to the North Carolina, South Carolina, and Virginia crops from Hurricane Matthew is yet to be determined. The Georgia crop may be overrated at the current estimate of 976 lbs/acre.

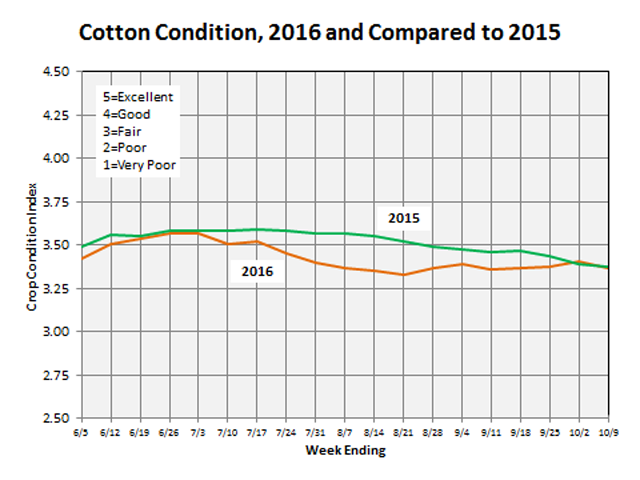

The US crop is currently pegged at 797 lbs/acre compared to 766 last season. For most of this season, the crop has lagged behind the 2015 crop in crop condition. As of October 2nd, the two seasons are now essentially the same, however. This year’s crop declined in July and most of August but has remained about the same during the month of September.

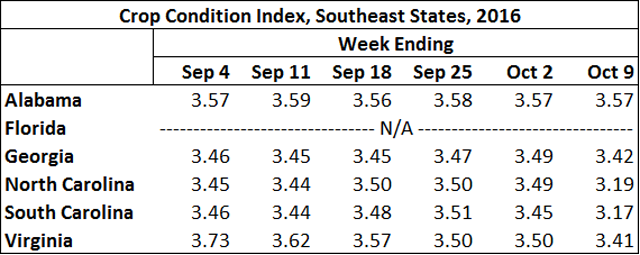

Looking at just the Southeast, since the first week in September the Georgia crop has been only fair to good (condition index around 3.5 or less). October has been very dry and may reduce yield potential on the portion of the crop still trying to develop.

The North and South Carolina crops, I assume due to Hurricane Matthew or cumulative effects of both Hermine and Matthew, declined significantly the week ending Oct 9th and may decline further. Unofficial early reports are that crop loss has been heavy in some areas.

In early September, the Virginia crop condition index was 3.73. The September yield forecast for Virginia was 733 lbs/acre. In early October the crop was rated lower at 3.50 yet the projected yield was revised upward to 933.

Looking ahead after harvest and into winter and spring, China will again be selling off government reserve in 2017. It’s been reported they will attempt to sell equal to this year’s amount.

As stocks continue to be used and stocks decline, it’s expected that the export pipeline to China may remain limited. Looking ahead to remaining price opportunities for the 2016 crop, this will depend on foreign production, hopefully a continued recovery in mill use, and thus US export opportunities.

Source:ufl.edu