By Bryn Swearingen

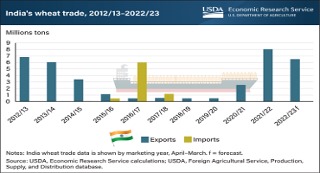

High global wheat prices and sales restrictions from some major exporters forced numerous wheat-importing countries to seek alternative suppliers in 2021 and early 2022. Foreign wheat buyers turned to India, one of the lowest-priced exporters, purchasing a record 8.033 million metric tons (MT) of India’s wheat in the 2021/22 marketing year (April/March). India’s wheat exports helped to offset reduced sales by other major exporters, including Russia, Ukraine, and the United States. Historically, India’s wheat exports are variable and largely dependent on domestic production, consumption, and export policies. In recent years, India’s production has exceeded consumption, resulting in increasing exportable supplies. As the 2022/23 marketing year begins, Ukraine’s seaports remain closed—limiting prospects for the nation’s wheat exports while enhancing the early outlook for India’s foreign sales. Indeed, in April 2022, India exported a record volume of wheat. However, a heat wave late in the growing season curtailed India’s wheat production, leading the Government of India to impose an export ban in May 2022 to ensure sufficient supplies were available to satisfy domestic demand. After imposing the ban—which allows for government-to-government sales for humanitarian purposes—India has continued to receive requests for exports to Bangladesh, Indonesia, Egypt, and other countries. Despite a record month of exports in April, the restriction is projected to limit India’s export potential for the remainder of the 2022/23 marketing year. India’s exports are projected to be 1.5 million MT lower than in 2021/22, but 3.9 million MT higher than 2020/21. This chart was drawn from “Country Focus: India,” which appeared in the USDA, Economic Research Service’s June 2022 Wheat Outlook.

Source : usda.gov