By Joana Colussi and Gary Schnitkey

Department of Agricultural and Consumer Economics

University of Illinois

Traditionally, grain transportation costs in Brazil have been much higher than in the United States, giving a competitive advantage to American production. Much of the reason for this advantage is poorer transportation infrastructure in Brazil. However, Brazil has been improving infrastructure so that transportation costs are narrowing. In recent years, factors leading to improved Brazilian infrastructure are expansion of agricultural frontiers, the need for new export corridors in the North and Northeast, investments in waterways, and new railroads for transporting grain. In December 2021, for example, the Brazilian government enacted a new legal framework for railways, and, in January 2022, a project enacted will encourage cabotage.

Northern Ports Increase the Exports Share

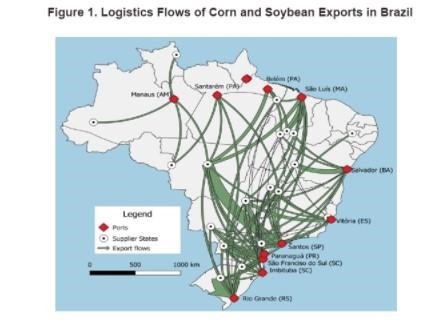

Historically, Brazil has always significantly depended on long-distance trucks for cargo hauling between the main producing regions and the southern ports, such as Santos, Paranaguá, São Francisco do Sul, and Rio Grande (see Figure 1). However, in the last decade, Brazilian grain export facilities along the Amazon River are gaining share of Brazil’s growing exports. For these northern ports, waterways play a more significant role in carrying corn and soybeans to ports. The main northern ports – called “Northern Arc” ports – are in Manaus, Santarém, Belém, São Luís, and Salvador (see Figure 1).

During the last few decades, crop production in Brazil has expanded mainly into the Midwest, North, and Northeast – especially in the Matopiba, an area formed by the Brazilian state of the Tocantins and parts of the states of Bahia, Maranhão, and Piauí (see farmdoc daily, July 12, 2021). The growth of agricultural production in this region drove the investments in new export corridors in the North and Northeast.

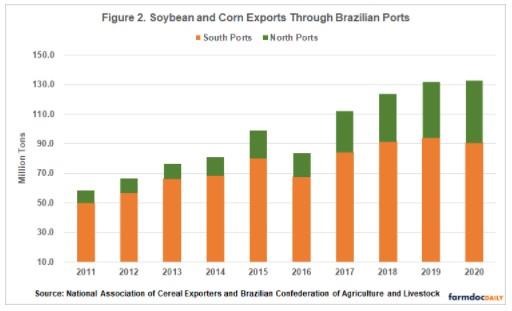

Over the past 10 years, the share of exports from northern ports grew from 14% to 32% (see Figure 2). Between 2011 and 2020, Brazilian exports of corn and soybeans through the northern and northeastern ports increased by 410%, from 8.3 million tons to 42.3 million tons, according to data from the National Association of Cereal Exporters and the Brazilian Confederation of Agriculture and Livestock.

The Law of Ports, enacted in 2013, stimulated investments in the North and Northeast terminals. The legislation defined rules for port terminals, incentives for private investments, and competition in the sector. Since then, the National Waterway Transport Agency has authorized 92 service terminals to operate in the “Northern Arc.” The year the law went into effect, the port terminals in Pará exported 1.9 million tons of grain. In 2020, the terminals in the northern state shipped 20.7 million tons of soybeans and corn.

One of the main roads connecting the ports of Pará to Mato Grosso, Brazil’s largest grain producer, is BR-163. The 663-mile stretch of BR-163 from Sorriso, North Mato Grosso, to Pará was completed in late November 2019. Using this new route, it takes about two days to ship grain by truck to terminals in Pará. As in the United States, this region’s proximity to ports lowers transportation costs, giving farmers a better price than their counterparts in other areas. In Brazil, short-haul trucking averages about 440 miles from farm to rail and barge terminals. In the United States, the average distance from farm to inland grain elevator terminals is about 25-100 miles (Salin, 2021).

Expectation of Logistics Diversification

Brazil has several projects underway to increase the efficiency of its transportation system. One is a new North-South railway line connecting northern Mato Grosso to a waterway in Pará, reducing the distance grains need to travel by truck. The agro-industrial logistics sector has been diversifying, especially since 2013, with the start of operations at the Rondonópolis (Mato Grosso) terminal, which in 2019 was the main multimodal terminal in Brazil. The installation of river trans-shipment terminals at the port of Miritituba (Pará) in 2015 also improved “Northern Arc” ports.

In December 2021, the Brazilian government enacted a new legal framework for railways, creating regulations that enable the private sector to invest in the railway sector. Another project approved on in Congress will encourage cabotage. Called “BR do Mar” (essentially Road of the Sea, in free translation), the initiative enacted in January 2022 will change rules to increase the supply of ships, including from foreign companies, and thus increase competition and lower navigation costs.

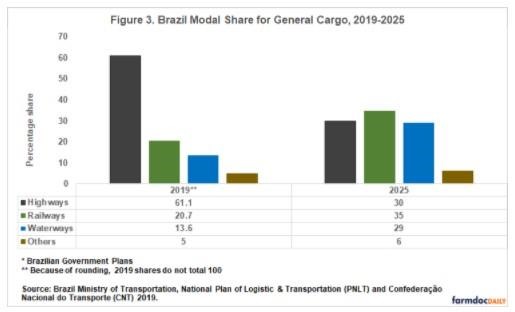

These new regulations and investments led the Brazilian government to project that barge and rail will play a more significant role in ferrying crops to port over the next five years. From 2019 to 2025, the share of highways for general cargo in Brazil is expected to decrease from 61.1% to 30%. Meanwhile, the role of railways in moving grain to ports will grow from 20.7% to 35%, and the role of waterways will more than double, from 13.6% to 29% (see Figure 3).

With the expansion of railways and inland waterways, the dependence on long-distance (direct) highway transport will decline and the demand for short-distance transport to supply the terminals directly will increase. It is essential to highlight that no one mode of transportation handles all-grain movements in Brazil. Instead, activities involve integrating highways, waterways, and railways to connect origins, departure terminals, and destinations (Péra, Caixeta-Filho, & Salin, 2021).

Cost of Transporting Soybeans

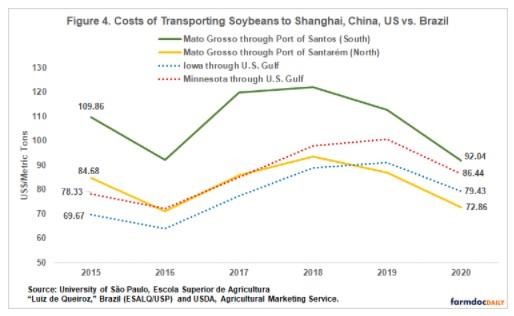

The historical U.S. transport cost advantage has decreased in recent years, as Brazilian costs declined. In 2020, for example, the cost per metric ton (mt) to ship soybeans from Mato Grosso through the port of Santos (South) to Shanghai, China, was $92.04, and from Mato Grosso through the port of Santarém (North) was $72.86. By comparison, in 2020, the cost of hauling U.S. soybeans from Minnesota to ports on the Gulf of Mexico for export to Shanghai was $86.44, and from Iowa, $79.43 (see Figure 4).

In 2015, the cost per metric ton to ship soybeans from Sorriso (Mato Grosso) through the port of Santos to Shanghai was $109.86, about $40 more than from Davenport, Iowa, through the U.S. Gulf. In 2020, this difference fell to $13. In five years, Brazilian transportation costs along this route declined 16%, while American costs increased about 14%.

In 2020, the cost per metric ton to ship soybeans from Sorriso (Mato Grosso) through the port of Santarém to Shanghai was $72.86, about $14 less than Minneapolis (Minnesota) and $7 less than Davenport, Iowa. The paving of BR-163 highway, connecting Mato Grosso and Pará, improved the route by shortening the time to complete the trip, and decreasing fuel and truck maintenance costs. The numbers show that transportation costs are shrinking for Brazilian agribusiness, although there are still many logistical challenges, such as infrastructure deficits.

Logistical challenges are likely to persist in Brazil in the coming years because of infrastructure deficits. According to data from the National Confederation of Transport, the Brazilian highway system encompasses 968,863 miles (1,562,682 kilometers), with nearly 14% of the roads paved. Meanwhile, the U.S. highway system consists of 4,124,867 miles (6,638,313 kilometers); 70% of U.S. roads are paved. The Brazilian railroad system consists of 12 railroads, and 18,641 miles of track, but only one-third of the railroads operate commercially, primarily in the South, Southeast, and Northeast. Brazil has 25,849 miles of navigable rivers of which 13,670 miles are commercially navigable.

Summary

In the past, Brazil has depended on long-distance road freight transport for grain hauling. However, the transportation infrastructure for grain hauling in recent years has changed as a result of several factors. Brazilian grain export facilities along the Amazon River are gaining share of Brazil’s growing exports. In addition, the historical U.S. transport cost advantage has decreased in recent years, as Brazilian costs have decreased. Brazil has several projects in the works to increase the efficiency of its transportation system. New regulations and investments have led the Brazilian government to project that barge and rail will play a more significant role in ferrying crops to port over the next five years. Despite recent advances, logistical challenges, however, are likely to persist in Brazil in the coming years because of infrastructure deficits.

Source : illinois.edu