The invasion of Ukraine by Russia touches us all. The unfolding tragedy hits close to home given the large Ukrainian community in Canada. Acknowledging the immense human and economic tolls of the war, we will focus here on the economic impacts on the Canadian ag and food sectors of the conflict and the associated sanctions.

Trade with Ukraine and Russia

An expected outcome of the war is that trade with Ukraine will slow down and that sanctions imposed on Russia will make trade with that country more difficult. Both Ukraine and Russia are not large trade partners to Canadian ag and food businesses. In the last five years, Canada has exported on average $65 million in ag and food products to Ukraine and imported for about $33 million of these products. Over the same period, on average, Canada has exported $80 million and imported for $93 million in ag and food products to Russia. These markets are small compared to Canada’s main trading partners, nonetheless they can be important to some Canadian businesses.

Grains and oilseeds

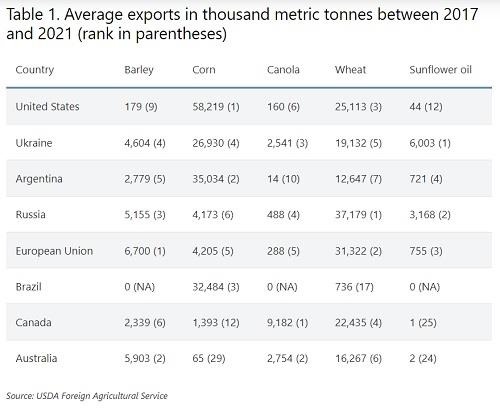

We expect the war to have an important impact on the grains and oilseeds market, adding more volatility to already unpredictable markets. Ukraine and Russia are major exporters of barley, corn, canola, wheat and sunflower oil (Table 1). If the conflict and accompanying sanctions negatively impact the production or the movement of those commodities, shortage on the world market or shifts in trade flows would cause prices to rise.

Ag commodity markets have already been shaken by the war. Last Thursday, futures for corn, soybean, canola and wheat were significantly up, some even hitting their daily upper limit. However, those gains were erased soon afterward as it appears that products related to the energy sector might be exempt of US sanctions. On Monday, following the announcement over the weekend of new and tougher sanctions on Russia, markets were again on edge with wheat up more than 5%.

Fertilizers

Fertilizer prices are already inflated because of various disruptions from the pandemic. The conflict could add to these disruptions if sanctions affect Russia’s fertilizer exports. This is in addition to Russia’s self-imposed export quota on fertilizer to control inflation within its borders.

In 2020, Russia was the world’s largest fertilizer exporter with exports reaching US$7 billion (World Bank WITS database). China, which is also limiting its exports, was second at US$6.6 billion and Canada was third at US$5.2 billion because of its potash exports.

Click here to see more...