By James Mitchell

Beef production involves the fabrication of a beef carcass into primal and subprimal cuts from which individual beef cuts are derived. Valuing a beef carcass involves working backward from these individual beef items. First, prices for beef cuts are combined to create subprimal values. Next, subprimal values are combined to calculate values for the seven beef primals: rib, chuck, round, loin, brisket, short plate, and flank. Finally, composite primal values are multiplied by their respective carcass yield percentages and summed to arrive at a beef cutout value for a specified quality grade (e.g., Choice cutout value). This is an oversimplification of the process, but the general idea is the same.

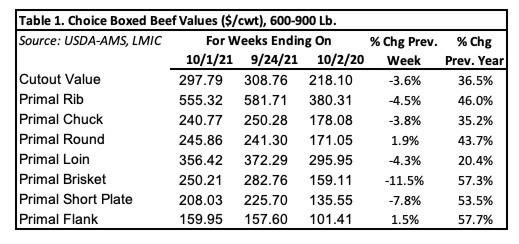

USDA-AMS reports boxed beef cutout values twice daily (LM_XB402 and LM_XB403) along with other boxed beef summary reports. Table 1 (see below) provides a summary of recent movement in the choice cutout value. For the week ending 10/1/21, the choice cutout value was $297.79/cwt, down 3.6% from the previous week but still 36.5% above this time last year. Table 1 also provides a summary for each Choice beef primal value. The rib primal, which is the highest valued beef primal, was down 4.5% last week. The loin and chuck primals were down 3.8% and 4.3% compared to the previous week. The round primal was 1.9% higher last week, while the brisket primal observed the largest weekly decline, down 11.5%.

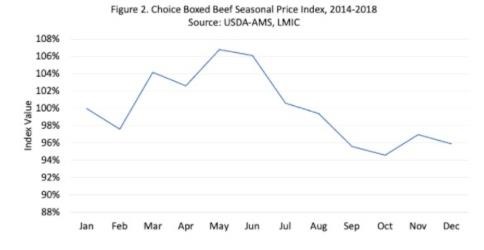

Like cattle prices, the boxed beef cutout value has a distinct seasonal pattern. Seasonality in the cutout value is driven by price seasonality for individual beef cuts. Based on monthly data from 2014-2018, choice boxed beef prices are seasonally highest in May, averaging 6.7% above the annual average price (Figure 2). The seasonal high in May aligns with peak beef demand during grilling season (Memorial Day to Labor Day). Choice cutout prices decline through the summer, reaching a low in October when prices average 5.5% below the annual average Choice cutout value. Choice boxed beef prices recover but remain below the annual average during the holiday beef buying season in November and December.

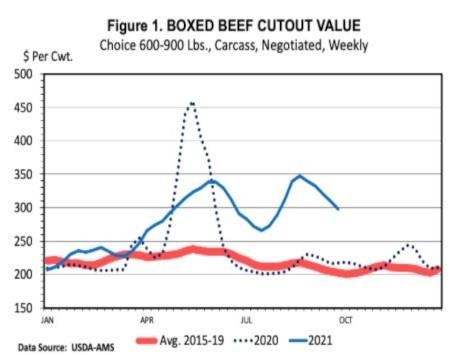

For the first half of 2021, the focus for beef markets was on replenishing restaurant outlets as vaccine rollout began and COVD-19 restrictions relaxed. At the same time, beef processors continued to struggle with labor and capacity issues. Together, consumer beef demand and processing challenges led to strong Choice cutout values through the first half of 2021. Figure 1 shows the Choice boxed beef cutout value steadily increasing through May, reaching a high of $338.56/cwt for the week ending 6/5/21. More recently, Choice boxed beef prices trended higher leading up to Labor Day, reaching a high of $347.02/cwt before declining through September. The recent decline in the Choice boxed beef cutout is partly explained by a normal seasonal pattern where prices decline through October.

There are lingering questions about consumer beef demand as we close out 2021 and move into 2022. Last year, we learned that consumers were willing to buy beef at higher prices. Recovery in the restaurant sector was undoubtedly a positive for the beef industry in 2021. As the holiday beef buying season approaches, will we observe a return to company holiday parties and large family gatherings? Will beef demand remain strong next year? Monitoring boxed beef cutout values through the remainder of 2021 will offer insights into these questions.

Source : osu.edu