Over the last few weeks, USDA has released a host of data on the beef and pork markets, which helps provide some insight into a question we’ve all been asking for a while: When will beef and pork markets return to some semblance of “normal”? Production estimates in the form of the Hogs and Pigs Report provide a detailed inventory of breeding and marketing hogs as of Sept. 1, while the Cattle on Feed Report provides monthly estimates of the number of cattle being fed for slaughter. USDA also gave us the Cold Storage Report, which shows the volume of commodities, including beef and pork, in freezer storage throughout the U.S. as of Aug. 31

In addition, USDA’s Economic Research Service updated the Food Price Outlook, which analyzes the consumer price index level for food, examines changes in the CPI for food, and constructs forecasts of the CPI for food for the next 12-18 months. In the same report, ERS also analyzes and models forecasts for the producer price index, which measures the average change in prices paid to domestic producers. Finally, the Crop Progress Report continues to illuminate the incredibly dry rangeland conditions facing many ranchers. All of these reports have been discussed individually, but put together they give important context to the meat case, both today and into the future.

CPI

There has been a lot of discussion about inflation over the last six months, and for good reason. According to the Economic Research Service, the price of beef and veal in the CPI has risen 5.2% from January-August 2021 compared to the same period in 2020. The forecast range for the entirety of 2021 for beef and veal is an increase of 5-6%. If this seems higher than usual, that’s because it is. The 20-year historical average increase for beef and veal is 4.4%. Despite this higher-than-average rate of increase, the forecast for 2021 is still well below the increase of 9.6% in 2020.

Turning to pork prices, things don’t get any calmer. According to ERS, pork prices in the CPI have risen 5.4% from January-August 2021 compared to the same time period in 2020. The forecast range for the entirety of 2021 is an increase of 6-7%. This year’s increase is well outside the 20-year historical average increase of 2.2%. Unlike beef, the significant increase in 2021 follows a similar increase of 6.3% in 2020.

The question everyone is asking (and no one can answer with 100% certainty) – what should we expect in the beef and pork case in 2022? So far, ERS is forecasting an increase of 2-3% for consumer prices of both beef and pork.

PPI

For all the discussion of the prices consumers have been paying for beef, things haven’t been any more stable for growers. According to ERS’ producer price index, the farm-level price producers have received has risen 8.7% from January-August 2021 compared to the same time period in 2020. The forecast range for the entirety of 2021 for farm-level cattle prices is an increase of 8-11%. But unlike the consumer side, this increase doesn’t follow increases in 2019 and 2020. In fact, farm-level cattle prices fell 0.8% in 2019 relative to 2018, and then another 4.9% in 2020 relative to 2019. The ERS PPI forecast range for farm-level cattle is an increase of 2-5%, fully surrounding the 20-year average increase of 3.4%.

Things are similarly topsy-turvy when we look at the prices pork producers are receiving. According to ERS, the PPI for wholesale pork has risen 17% from January-August 2021 compared to the same time period in 2020. The forecast PPI range for the entirety of 2021 for wholesale pork is an increase of 17-20%. This year’s increase is far, far outside the 20-year historical average increase for wholesale pork of 1.9%. Despite the incredible variation in 2021, the PPI forecast for wholesale pork in 2022 is for an increase of 1-4%.

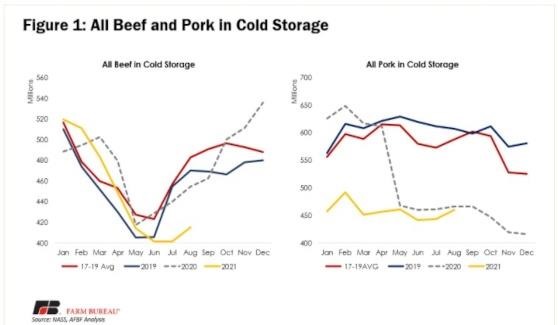

Cold Storage

Beef and pork supplies in cold storage crept up in August compared to low stocks that were on hand in June and July, but the supplies still remain considerably lower than in 2020 and lower than average levels from 2017 through 2019. The supply of beef in cold storage on Aug. 31 was 13.664 million pounds greater than the supply on July 31. This 3.4% increase helped ease pressure a bit, though August 2021 stocks were 9% below August 2020 and 14% below average stock levels for August 2017-2019. The supply of pork in cold storage on Aug. 31 increased 16.931 million pounds over July 31. This 3.8% increase brought August 2021 stocks within 1% of August 2020 levels, but still 22% below the August 2017-2019 average stock levels.

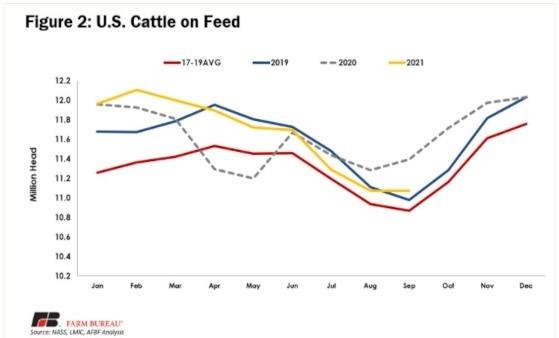

September Cattle on Feed Report

USDA’s latest Cattle on Feed report, released Sep. 24, shows a total inventory of 11.075 million head on feed as of Sep. 1, down 2.8% from the same time in 2020, but up 0.8% from 2019. It is important to remember that due to COVID-19 disruptions last year, typical year-over-year comparisons need to be contextualized. This decline is part of a normal seasonal decline that typically occurs throughout the summer and into September. It also reflects where we are in the contraction phase of the cattle cycle.

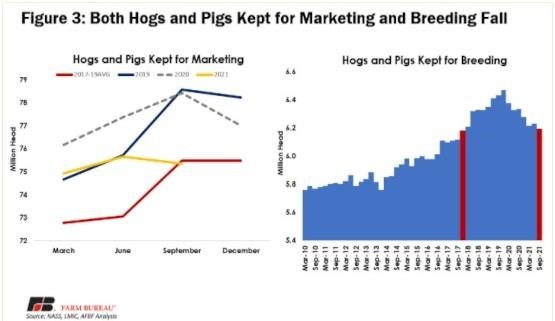

September Hogs and Pigs

Last week, USDA’s National Agricultural Statistics Service also released its latest Quarterly Hogs and Pigs report, providing a detailed inventory of breeding and marketing hogs as of Sept. 1.

The report showed that on Sept. 1, all hogs and pigs were down to 75.352 million head, a decline of 3.9% from the same time last year. This was below pre-report estimates of 1.7%-2.0%.

The report also shows the smallest number of hogs kept for breeding, 6.190 million, since the December 2017 report. We are now 4.3% below the peak breeding stock numbers reached in December 2019. A return to a record litter rate, measured in pigs per litter, was reported at 11.13 in September 2021, an increase of 0.6% over September 2020.

Rangeland Condition

In non-breaking, but very important news, it’s still very dry out there. According to this week’s Crop Progress Report, a whopping 46% of pastureland across the U.S. is in poor-to-very-poor condition in the 38th week of the year, approximately equal to the end of September. The five-year average at this point in the year is 21%. Only 23% of pastureland is rated good to excellent. The five-year average at this point in the year is 42% in good-to-excellent condition. Currently, more than half of the rangeland in California, Idaho, Minnesota, Montana, Nevada, North Dakota, Oregon, South Dakota, Utah, Washington and Wyoming is classified as poor or very poor. In a race no one wants to win, Montana leads the country in poor pasture condition, with 92% of pastureland in poor-to-very-poor condition. Read about on-the-ground conditions in Montana here.

Click here to see more...