By Ryan Hanrahan

Reuters’ P.J. Huffstutter reported that “Chicago Board of Trade corn futures (last) Friday dipped below $4 per bushel in the front-month contract Cc1 for the first time since November 2020, as hefty U.S. and global supplies weighed over the market.” May corn futures prices, however, remained above $4, closing at just above $4.13 last Friday.

“The speed at which corn prices have fallen has startled growers and market analysts, who say low prices could impact the U.S. farm economy as producers are finalizing their spring planting plans,” Huffstutter wrote.

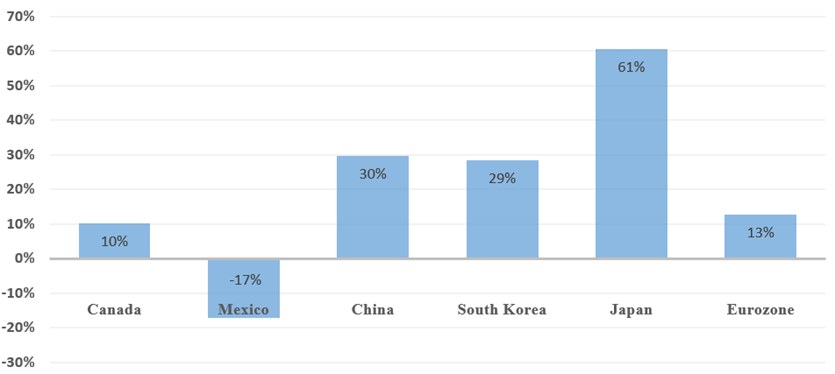

CBOT Corn Futures Prices. Courtesy of Reuters.

The Illinois Grain Bids report, for Feb. 23, showed central Illinois average prices for corn at $3.77. The Iowa Daily Cash Grain Bids report, for Feb. 23, showed Iowa average prices for corn at $3.91.

Why Prices are Dropping

Reuters’ Karen Braun reported last week that “the expectation for massive U.S. corn stockpiles both this year and next has driven the decline of futures prices. A record 2023 crop is seen lifting 2023-24 ending stocks by 60% over the previous season.”

“USDA last week projected an additional 17% climb in ending stocks for 2024-25, which starts Sept. 1,” Braun wrote. “The 2.532 billion-bushel figure would represent the largest U.S. carryout since 1987-88.”

Reuters’ Tom Polansek reported last week that some of those U.S. stockpiles are due to U.S. growers who “miscalculated when they held on to corn (after harvest) rather than booking sales. The ‘store and ignore’ strategy of waiting for higher prices has not paid off, leaving some farmers cutting back purchases of pricey equipment and planting less corn.”

Huffstutter reported that Karl Setzer, partner at Consus Ag Consulting said that “‘there is literally nothing holding up the corn market right now, because we just produced too much. It doesn’t matter that we have corn demand, or that ethanol production is up 4.3% from last year, or that feed demand is perking up,’ he said. ‘There’s just too much corn.'”

Why Low Prices are Problematic

Braun reported last week that “just a few years ago, corn at or above $4 per bushel was often viewed favorably by U.S. farmers from a profit perspective. But $4 today is not the same as it was back then since production costs remain elevated after spiking a couple of years ago.”

“In Wamego, Kansas, Glenn Brunkow, a fifth-generation crop and livestock farmer, plans to delay upgrades to machinery and may try to repair equipment himself, rather than paying a dealership,” Polansek reported. “‘We’re tightening expenses as much as we can,’ he said. ‘We’re trying to limp through putting off some expansion with the livestock, just trying to limp by.'”

Outlook Isn’t Positive

“Analysts do not expect a major bump in demand to draw down corn stockpiles,” Polansek reported. “U.S. exports of agricultural and related products fell 10% by value in 2023 to a three-year low, as plentiful supplies from Brazil and elsewhere challenged U.S. export sales.”

“Demand from the U.S. meat industry, which feeds corn to livestock, is limited as pig farmers face lackluster pork demand while cattle ranchers slashed their herds due to drought in the Great Plains,” Polansek wrote.

“Biofuel demand, which typically accounts for about one-third of U.S. corn production, also worries Rod Weinzierl, executive director of the Illinois Corn Growers Association, as Americans buy more electric vehicles,” Polansek reported. “‘This year every fork in the road has been bearish,’ said Matt Wiegand, commodity broker for risk management firm FuturesOne in Nebraska.”

Source : illinois.edu