By Andrew Sandeen

Dairy Revenue Protection (DRP) is an insurance program for U.S. dairy producers who are looking to manage financial risk and minimize the impact of unanticipated declines in milk prices. Locking in a milk price for a future quarter can be a useful risk management strategy, establishing baseline revenue without losing potential on the upside.

Government-subsidized DRP policies can be set up through private agents, much like crop insurance. It is recommended to work with an agent who is knowledgeable on the topic and accommodating with the services they provide. The initial process to set up a policy is free and typically quite simple. Specific endorsements can be purchased as frequently or infrequently as desired. Premiums do not become due until the month following the end of the quarter.

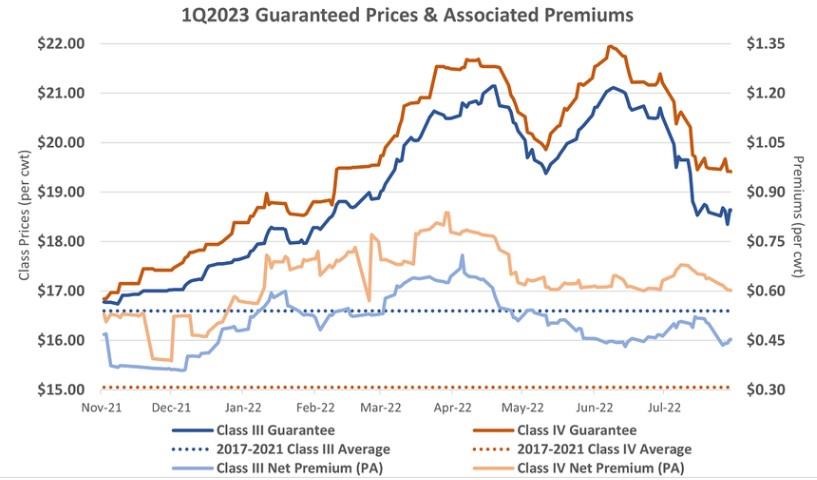

The chart below shows historical price guarantees with the maximum 95% coverage along with associated net premiums (after subsidy) specific to Pennsylvania for the third quarter of this year. Milk prices softened a little bit in April but rebounded nicely in the final weeks of May, remaining several dollars above historical class price averages. Premiums have declined to about one third of what they were a few months ago, so the beginning of June looks like a nice time to lock in some high prices before the opportunity window for acquiring 3Q2022 coverage closes in the middle of the month.

There are five key decisions that need to be made when purchasing a DRP endorsement with the maximum 95% coverage, which is 44% subsidized:

- Quarter – Endorsements are only available for entire quarters of the calendar year (e.g. January through March as Quarter 1). At any one time, sales are open for as many as five future quarters. Sales close 15 days before the beginning of the quarter. Distant quarters don’t open for sale until there is adequate market activity.

- Price category – The choices are Class III milk, Class IV milk, or a selected butterfat and protein combination. The only obligation is that 85% of the covered milk volume or 90% of the components be delivered in order to receive full payments.

- Quantity – Any volume can be selected for an endorsement, with no limit to the number of endorsements within a particular quarter.

- Protection factor – This is a factor built into the program for the purpose of increasing coverage on a specific volume of milk up to 1.5 times the covered volume. A higher protection factor level will increase coverage (and the premium) at the same milk volume.

- Date – The market changes daily. Endorsements must be purchased between the market closing and the next opening, meaning the time window on the East Coast is typically between 4 p.m. and 10 a.m. the following morning.

Below are the highest quarterly Class III and Class IV prices to date. The prices and associated premiums change almost every weekday, so this just captures the high points to demonstrate the recent potential for DRP coverage. Notice that DRP indemnity payments would not have been possible for Class III milk in some quarters (e.g., 1Q2022) because of the high ending prices, whereas the payment potential was high in other quarters (e.g., 3Q2021). Indemnity payments are determined by calculating the difference between expected revenue and actual revenue according to market prices, adjusted on a state or regional basis to account for differences between expected and actual milk production. If the DRP guaranteed price captured with an endorsement is above the final announced milk price, a payment can be expected.

Class III

| Highest DRP Prices (as of May 31, 2022) | Date Occurred | Expected Market Price (on that date) | DRP Price Guarantee (95% of Expected Market Price) | PA Premium ($/cwt) | Actual Market Price (at completion of quarter) |

|---|

| 3Q2020 | 6/9/20 | $18.34 | $17.42 | $0.2788 | $20.25 |

| 4Q2020 | 1/24/20 | $17.96 | $17.06 | $0.1646 | $20.22 |

| 1Q2021 | 11/10/20 | $17.46 | $16.59 | $0.3692 | $15.98 |

| 2Q2021 | 3/11/21 | $18.29 | $17.38 | $0.2008 | $17.95 |

| 3Q2021 | 5/12/21 | $20.03 | $19.03 | $0.3119 | $16.32 |

| 4Q2021 | 5/12/21 | $19.30 | $18.34 | $0.4285 | $18.07 |

| 1Q2022 | 12/13/21 | $19.99 | $18.99 | $0.2052 | $21.25 |

| 2Q2022 | 3/8/22 | $24.54 | $23.31 | $0.2997 | TBD |

| 3Q2022 | 4/14/22 | $24.68 | $23.45 | $0.4353 | TBD |

| 4Q2022 | 4/18/22 | $23.74 | $22.55 | $0.5381 | TBD |

| 1Q2023 | 4/19/22 | $22.25 | $21.14 | $0.5851 | TBD |

| 2Q2023 | 4/14/22 | $21.10 | $20.05 | $0.6307 | TBD |

| 3Q2023 | 4/18/22 | $20.12 | $19.11 | $0.6938 | TBD |

Class IV

| Highest DRP Prices (as of May 31, 2022) | Date Occurred | Expected Market Price (on that date) | DRP Price Guarantee (95% of Expected Market Price) | PA Premium ($/cwt) | Actual Market Price (at completion of quarter) |

|---|

| 3Q2020 | 1/21/20 | $18.40 | $17.48 | $0.1317 | $13.01 |

| 4Q2020 | 1/24/20 | $18.38 | $17.46 | $0.1727 | $13.38 |

| 1Q2021 | 1/24/20 | $17.83 | $16.94 | $0.1802 | $13.71 |

| 2Q2021 | 1/17/20 | $17.95 | $17.05 | $0.1906 | $15.98 |

| 3Q2021 | 5/18/21 | $17.74 | $16.85 | $0.2309 | $16.09 |

| 4Q2021 | 5/19/21 | $18.06 | $17.16 | $0.4226 | $18.57 |

| 1Q2022 | 12/15/21 | $20.63 | $19.60 | $0.1462 | $23.97 |

| 2Q2022 | 3/14/22 | $25.20 | $23.94 | $0.2342 | TBD |

| 3Q2022 | 5/31/22 | $25.75 | $24.46 | $0.1812 | TBD |

| 4Q2022 | 5/31/22 | $24.58 | $23.35 | $0.4717 | TBD |

| 1Q2023 | 4/12/22 | $22.83 | $21.69 | $0.7756 | TBD |

| 2Q2023 | 4/11/22 | $21.60 | $20.52 | $0.7262 | TBD |

| 3Q2023 | 5/31/22 | $20.35 | $19.33 | $0.7268 | TBD |

Consider how the DRP program might fit into the risk management portfolio for a dairy operation. It provides a different type of coverage than other programs (e.g. Dairy Margin Coverage). There are agents, educators, dairy producers, and others who are familiar with the program and can help with the initial learning curve. After getting started, it is just a matter of setting a strategy to capture the right opportunities.

Source : psu.edu