In a slowing economy pork remains well-positioned, as demand for the protein is historically less income-sensitive than more expensive proteins like beef and premium seafood. “Nevertheless, we see persistently high retail prices limiting consumption of all proteins. Consumers continue to conserve capital by shifting everyday purchases to lower-value protein options, switching channels, and moving to smaller pack sizes,” says Christine McCracken, Senior Analyst – Animal Protein at Rabobank. Moreover, industry optimism in 2022 following a notable upward shift in pork consumption (and prices) in some markets and expectations of a 2023 recovery of pandemic-restricted consumption in others contributed to planned supply growth in 2023. That growth will take time to curb. “Slowing supply in Europe will help balance the industry, yet high costs of production and limited consumer support will require a more conservative approach to production to stabilize margins,” explains McCracken.

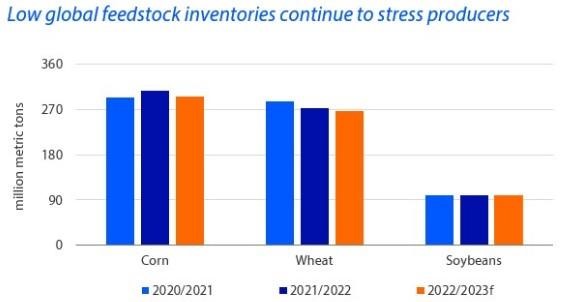

Although a modest improvement in production costs is expected in 2023, local conditions will vary and risk management will remain critical to success. Global feed stocks are at historically low levels, and availability remains tight. A disappointing Argentine harvest will partially offset Brazil’s record 2023 soybean and safrinha corn crops, leaving the market to focus on import needs, Black Sea grain availability (the current trade extension will expire in the coming months), and the successful planting of a new crop in the Northern Hemisphere. “Rabobank expects the small global cushion in grain and oilseed stocks to drive additional feed cost volatility in 2023,” states McCracken.

Adding to the volatility, recent outbreaks of African swine fever (ASF) in commercial operations in China, South Korea, the Philippines, and Europe are perpetuating concerns of lower availability and trade interruption. Market reactions to ASF outbreaks remain most disruptive in China, given the large hog population there. Concerns about new losses drove proactive farmer culling in late 2022 and continue to affect the rate of restocking in early 2023. Losses appear contained and remain regional, however, which should limit market impact. Currently, global pork supplies appear sufficient, though a sizable shortfall in China due to disease would disrupt the global industry and drive a sharp upward correction in pork prices.

In other regions, improvements in biosecurity, genetics, and herd health are beginning to boost productivity. Herd health is improving in many markets as the impacts of porcine reproductive and respiratory syndrome (PRRS) and porcine epidemic diarrhea virus (PEDv) begin to abate. Improved productivity in the US and Mexico is expected to bring added supply and could potentially burden the market, as a rapid improvement in productivity could result in excess supply and require further industry adjustment.

Source : Rabobank