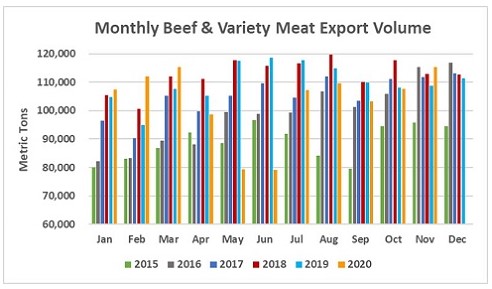

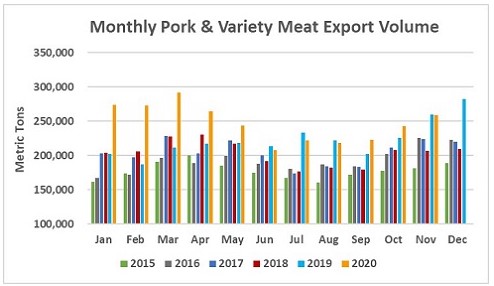

U.S. beef exports posted one of the best months on record in November, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). November was also a strong month for pork exports, which already surpassed the full-year volume and value records set in 2019.

“Demand for U.S. beef in the global retail sector has been outstanding and we expect this to continue in 2021,” said USMEF President and CEO Dan Halstrom. “Unfortunately, foodservice continues to face COVID-related challenges. We expect a broader foodservice recovery this year, especially from mid-2021, but will likely still see interruptions in some markets. For U.S. pork, it’s great to set new records with an entire month to spare, but especially gratifying to see a diverse range of markets contributing to U.S. export growth. USMEF still expects strong pork demand from China in 2021, but we’re seeing a much-needed rebound in other regions, especially in Western Hemisphere markets.”

November beef exports totaled 115,337 metric tons (mt), up 6% from a year ago and the largest since July 2019. Export value climbed 8% year-over-year to $707.5 million. Through November, exports were 6% lower year-over-year in volume (1.13 million mt) and down 7% in value ($6.9 billion). November beef muscle cut exports were the third largest on record at 91,338 mt (up 13%, trailing only July and August 2019), valued at $630.4 million (up 11%). January-November muscle cut exports were 3% below 2019 in volume (883,012 mt) and 6% lower in value ($6.11 billion).

Beef export value averaged $338.43 per head of fed slaughter in November, up 10% from a year ago and the highest since April. The January-November average was $298.01, down 3% from a year ago. Exports accounted for 14.8% of November beef production and 12.6% for muscle cuts only, each up significantly from a year ago (13.7% and 11%, respectively). January-November exports accounted for 13.3% of total beef production and 11.1% for muscle cuts, down from 14.1% and 11.4%, respectively, in 2019.

November pork export volume was steady year-over-year at 258,801 mt, with value down 2% at $697.5 million. January-November results set new annual records for both volume (2.72 million mt, up 14% from the previous year’s pace) and value ($7.03 billion, up 13%). Pork muscle cut exports also shattered previous annual records, increasing 18% year-over-year to 2.29 million mt, valued at $6.08 billion (up 15%).

Pork export value equated to $63.33 per head slaughtered in November, up 1% from a year ago and the highest since May. The January-November average was $58.53, up 12%. Exports accounted for 29.9% of total pork production in November and 27% for muscle cuts, each up slightly from November 2019. Through November, exports accounted for 29.3% of total production and 26.6% for muscle cuts, each up significantly from the 2019 ratios of 26.4% and 23%.

Record shipments to China, welcome rebound in Mexico lead November beef exports

Beef exports to China continued to reach new heights in November at 8,372 mt, up 700% from a year ago, with value up 642% to $60.1 million (by comparison, exports to China for all of 2019 totaled $86.1 million). For January through November, exports to China totaled 33,081 mt (up 277% year-over-year) valued at $237.8 million (up 239%). Shipments to China have trended higher since the March implementation of the U.S.-China Phase One Economic and Trade Agreement, but have been especially strong since the mid-summer rebound in China’s foodservice sector. The U.S. is now the largest supplier of grain-fed beef to China, with U.S. grain-fed volumes surpassing Australia’s monthly shipments since September.

COVID-19’s impact on Mexico’s beef demand has been more persistent, driving 2020 exports sharply lower. But November results were very encouraging, with exports fully rebounding to pre-COVID levels and reaching the highest volume since 2016 at 22,871 mt, up 23% from a year ago, valued at $105.1 million (up 21%). Through November, beef exports to Mexico were down 23% in volume (165,721 mt) and 28% lower in value ($725.7 million) compared to 2019.

November was another excellent month for beef exports to Taiwan, with volume up 8% from a year ago to 5,242 mt, valued at $48.7 million (up 13%). A strong December could push exports to Taiwan to another annual record, as January-November exports were 3% above 2019’s record pace at 59,404 mt, valued at $509.1 million (down 1%). The United States continues to dominate Taiwan’s chilled beef imports, capturing 76% market share.

Other January-November highlights for U.S. beef exports include:

- Exports to leading market Japan were steady with November 2019 at 23,871 mt, with value down 3% to $157.5 million. Through November, exports to Japan trailed the 2019 pace by 2% in both volume (280,954 mt) and value ($1.77 billion). Muscle cut exports to Japan have fared better, increasing 4% to 238,539 mt valued at $1.44 billion (down 1%).

- November beef exports to South Korea were down slightly from a year ago to 18,950 mt, valued at $134.8 million (down 3%). Through the first 11 months of the year, exports to Korea trailed the record pace of 2019 by 3% in volume (228,051 mt) and 6% in value ($1.59 billion). However, U.S. beef gained market share in Korea in 2020, capturing 52.7% of total imports (up from 50.8% for the same period in 2019) and 64.1% of chilled imports (up from 61.6%). Korea’s imports of U.S. chilled beef set another new record in 2020, totaling more than 62,000 mt through November.

- Led by a record month for Guatemala, November beef exports to Central America rebounded to 1,687 mt, up 36% from a year ago, valued at $10.9 million (up 51%). January-November exports to the region were still down 11% from a year ago in volume (12,449 mt) and 15% in value ($67.8 million), with demand heavily impacted by a reduction in foodservice activity.

Pork exports strengthen to Japan, Mexico, CAFTA region

Although China/Hong Kong remained the largest destination for U.S. pork in November, momentum continued to build in other markets. November exports to Japan increased 6% from a year ago to 34,676 mt, valued at $146.4 million (up 7%). Through November, exports to Japan were up 4% year-over-year in volume (353,636 mt) and increased 6% in value ($1.49 billion). U.S. share of Japan’s total pork imports increased to 36%, up from 31% in 2019, driven by strong demand for U.S. ground seasoned pork and chilled and frozen U.S. pork cuts, following the Jan. 1, 2020 implementation of the U.S.-Japan Trade Agreement.

U.S. pork shipments to Mexico continued to trend higher in November at 65,136 mt, up 13% from a year ago, with value steady at $124 million. Through November, exports were down 4% to 616,827 mt, valued at $1.02 billion (down 11%). Pork muscle cut exports to Mexico were steady with 2019 at 520,157 mt, valued at $871.2 million (down 9%). U.S. share of Mexico’s pork imports jumped to 87% in 2020, up from a low of 82% in 2019.

Led by Honduras and Guatemala, November pork exports to Central America increased 8% year-over-year in both volume (10,712 mt) and value ($26.7 million). Through November, exports to the region pulled within 1% of 2019’s record pace at 86,349 mt, valued at $209.2 million (also down 1%).

Click here to see more...