By Jonathan Coppess

Department of Agricultural and Consumer Economics

University of Illinois

Congress is currently considering funding legislation for the federal government in what will be the last piece of legislation of the 117th Congress. Known as the consolidated or omnibus appropriations bill, it provides funding for multiple agencies for fiscal year (FY) 2023, which began on October 1, 2022. Omnibus appropriations bills have become the norm in recent Congresses—regardless which party controls Congress or either chamber—because appropriators and leadership have been unable to overcome objections and other obstacles to completing the individual appropriations bills in regular order. The FY2023 appropriations bill was released by the Senate Appropriations Committee on December 20, 2022, as a substitute amendment to an earlier appropriations bill from the House, it measures 4,155 pages of legislative text and is estimated to provide $1.7 trillion in funding (H.R. 2617, Senate Substitute Amendment; Senate Appropriations Committee, December 20, 2022), see also, Cochrane, December 20, 2022; Romm, December 20, 2022). This article reviews the agricultural funding provisions in the omnibus.

General Appropriations

Division A of the omnibus contains the appropriations for USDA, the FDA and related agencies. Much of the legislative language is standard, funding for salaries and expenses of the myriad agencies and offices in USDA provides, as well as other discretionary accounts. It provides $25.48 billion for USDA funding (Senate Appropriations, Agriculture, Bill Summary). For example, the bill provides over $1.2 billion for salaries and expenses of the Farm Service Agency (FSA, pg. 30), provides lending authority of $3.5 billion for guaranteed farm ownership loans and $3.1 billion for direct farm ownership loans through the Agricultural Credit Insurance Fund (ACIF, pg. 34), nearly $67 million for the salaries and expenses of the Risk Management Agency (RMA, pg. 35), and over $940 million for salaries and expenses for the Natural Resource Conservation Service (NRCS, pg. 36), as well as $351 million for Rural Development agency salaries and expenses.

The bill also reimburses the “net realized losses” of the Commodity Credit Corporation (CCC) and for payments by the Federal Crop Insurance Corporation Fund (FCIC) (pg. 40). These are the funding mechanisms for all farm program payments and conservation program payments (CCC), as well as the crop insurance program (FCIC). For example, USDA reported to Congress estimated net realized losses of $14.4 billion for FY2022 and $13.6 billion FY 2023 (USDA, 2023 Explanatory Notes: CCC). RMA reported total indemnities of $13.3 billion for the 2022 crop year to date (RMA, Summary of Business Report: 2020-2023). The omnibus does not indicate the totals appropriated to cover the costs from these accounts, however.

For the school lunch program and child nutrition expenses, the bill provides $28.5 billion to cover the costs of the program. It provides $6 billion for the special supplemental nutrition program for Women, Infants, and Children (WIC), and $154 billion for the Supplemental Nutrition Assistance Program (SNAP) (pg. 69-70). To put these costs in perspective, USDA reported to Congress an expectation that SNAP participation would be 43.5 million persons on a monthly average basis during FY2023; it budgeted for 5.6 billion school lunches and snacks in FY2023 (USDA, 2023 Explanatory Notes: FNS). USDA reported that 41.2 million people (21.6 million households) participated in SNAP on a monthly basis during the previous fiscal year (2022) and that individuals received on average $231.58 per month, $441.63 per month on average per household (USDA, FNS, SNAP Program Data: FY19 through FY2022). Total average participation in the school lunch program was 29 million as of December 2022, with 4.8 billion lunches served (USDA, FNS, Child Nutrition Tables: National Level Summary Tables).

Disaster Relief and Other Provisions

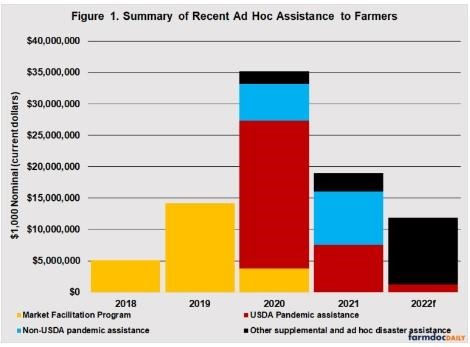

The omnibus bill also contains disaster relief supplemental appropriations for agriculture in Title I of Division N (pg. 1860). Congress appropriated $3.7 billion for revenue, quality or production losses of crops (including milk), trees, bushes, and vines, “as a consequence of droughts, wildfires, hurricanes, floods” and other natural disasters; $494.5 million of the funding is designated for livestock disaster losses (pg. 1860). This continues the recent pattern of large infusions of ad hoc assistance based on disasters and the Covid-19 pandemic. Since the Market Facilitation Program in 2018, USDA and Congress have added this ad hoc assistance on top of farm program payments and crop insurance indemnities. This trend may have implications for any upcoming farm bill reauthorization (see e.g., farmdoc daily, July 29, 2020). Figure 1 summarizes the ad hoc assistance to farmers since 2018 as reported by the Economic Research Service (USDA, ERS, Farm Income and Wealth Statistics: Federal government direct farm payments by program). The $3.7 billion in the omnibus would be in addition to these funds, as well as in addition to assistance through farm programs and crop insurance.

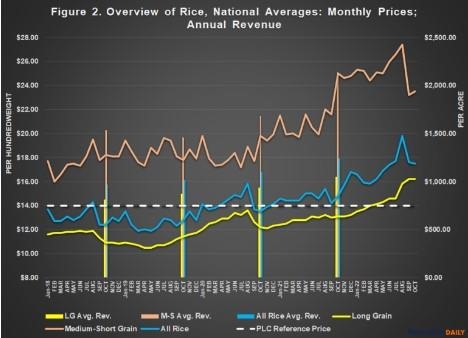

In Title V, Congress appropriated $100 million for pandemic-related assistance to cotton merchandisers that purchased cotton from U.S. farmers since March 1, 2020 (pg. 3976). In Title V, Congress also appropriated $250 million to make a one-time payment to rice farmers for acres planted or prevented from being planted in 2022. A curious matter, these payments are in addition to the estimated $506 million in payments and other assistance to rice farmers for FY2023 and nearly $501 million in total indemnities reported for the 2022 crop of rice (USDA, 2023 Explanatory Notes: CCC; RMA, Summary of Business Reports: National Summary by Crop, 2022). Figure 2 illustrates data about rice as reported by USDA, NASS: the monthly average prices received by farmers (lines) and annual average revenues (bars; marketing year average prices multiplied by national average yields) for long grain, medium-short grain, and all rice, as well as the PLC reference price (USDA, NASS, Quickstats).

Title I of Division HH also pertains to agriculture and it includes the Growing Climate Solutions Act (S.1251), which passed the Senate in June 2021 but had not moved in the House. The bill authorized USDA to establish a voluntary program for greenhouse gas technical assistance and for third-party verification, as well as other efforts to help farmers who seek to participate in efforts to reduce greenhouse gases or address climate change. The goal is to help reduce entry barriers into voluntary environmental credit markets for farmers, ranchers and private forest landowners. Inclusion of this bill in the omnibus is notable in light of the large investments in addressing climate change by the Inflation Reduction Act of 2022 (farmdoc daily, August 11, 2022; August 12, 2022; August 22, 2022). Finally, the omnibus also contains the Pesticide Registration Improvement Act of 2022 in Title VI (pg. 3980). The provisions cover pesticide labeling requirements, other registration issues such as service fees, and maintenance fees; last revised in 2018, the provisions were scheduled to expire in September 2023 (P.L. 116-8).

Concluding Thoughts

As the last piece of legislative business by the 117th Congress, Senators and Representatives are expected to pass the omnibus appropriations bill before they adjourn. With that bill, Congress will have funded the federal government for fiscal year (FY) 2023, which runs through September 30, 2023. The omnibus contains discretionary funding for USDA agencies and programs, as well as including additional ad hoc assistance to farmers. Finally, it includes the Growing Climate Solutions Act that had previously passed the Senate but not the House.

Source : illinois.edu