By Keith Good

DTN Managing Editor Anthony Greder reported yesterday that, “The 2023 U.S. corn harvest is slightly outpacing the five-year average so far as the crop continues to reach maturity ahead of normal, USDA NASS stated in its weekly Crop Progress report on Monday. Soybeans, too, continue to reach maturity ahead of the five-year average.”

2023 Crop Progress and Conditions. Charts and Maps. USDA- National Agricultural Statistics Service (September 11, 2023)

“In its first national corn harvest report of the season, NASS estimated that 5% of the crop was harvested as of Sunday, equal to last year but slightly ahead of the five-year average of 4%,” the DTN article said.

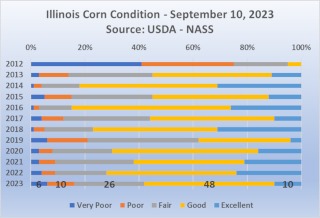

Greder pointed out that, “USDA said 52% of the corn crop was rated good to excellent as of Sept. 10, down 1 point from 53% last week and 1 point lower than a year ago.

“‘The good-to-excellent rating rose 1 point to 58% in Illinois, and Iowa fell 3 points to 46%, while Kansas and Missouri remain the worst-rated, at just 31% and 35% good to excellent, respectively,’ noted DTN Senior Analyst Dana Mantini.”

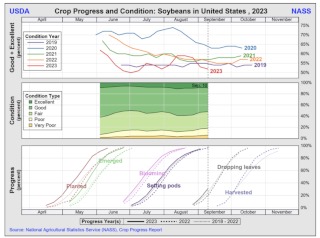

With respect to soybeans, the DTN article indicated that, “USDA said 31% of the crop was dropping leaves, 11 percentage points ahead of last year and 6 points ahead of the five-year average of 25%.”

2023 Crop Progress and Conditions. Charts and Maps. USDA- National Agricultural Statistics Service (September 11, 2023).

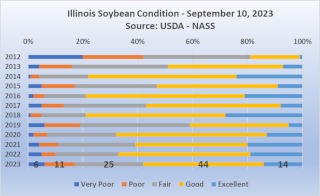

Yesterday’s article added that, “USDA said 52% of the soybean crop was rated good to excellent, down 1 point from 53% last week and below 56% last year.

“‘The good-to-excellent rating for Illinois was unchanged at 58%, and it declined 5 points in Iowa to 44% good to excellent,’ Mantini said. ‘Kansas is the worst-rated at just 23% good to excellent.'”

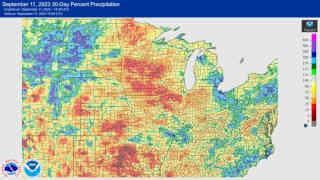

Reuters writer Naveen Thukral reported today that, “The weekly condition ratings for the U.S. soybean and corn crops declined in the past week, hovering at their lowest levels in a decade as dry conditions expanded, government data showed after the market closed on Monday.”

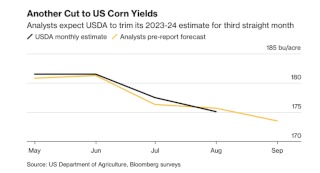

Yesterday, Bloomberg writer Doug Alexander reported that, “Grain buyers will be closely watching for the latest insights from the US Department of Agriculture.

"The agency is widely expected to trim its domestic corn yield estimate for a third straight month in Tuesday’s World Agricultural Supply and Demand Estimates report."

“Analysts expect the USDA to pare estimates to 173.5 bushels an acre for America’s most dominant crop. While this year’s harvest is seen to be bigger than in 2022, disappointing yields will mean tighter American supplies given last year’s shortfall. Corn is key to the global food supply, and a disappointing US harvest could have ripple effects on global markets.”

“Five Key Charts to Watch in Global Commodities This Week,” by Doug Alexander. Bloomberg News (September 11, 2023).

Dow Jones writer Kirk Maltais reported yesterday that, “U.S. export inspections of corn perked up for the week through September 7, according to government data.

“Corn export inspections rose 29% to a total of 623,862 metric tons for the week, the U.S. Agriculture Department’s latest report showed. That’s up from the 482,789 tons reported the USDA cited in its report for the previous week. Soybean export inspections fell from the previous week, dropping to 310,073 tons, while wheat inspections inched up to 406,181 tons.”

Maltais explained that, “September 1 marked the beginning of the new 2023/24 marketing year for corn and soybeans. They finished the previous marketing year of 2022/23 with corn inspections 32% behind the previous year and soybean inspections down 8%.

“To start the new marketing year, corn is now 4.4% ahead of last year’s pace – while soybeans are down 21.3%. Wheat inspections are off by 26% from where they were last year.”

Also yesterday, DTN Basis Analyst Mary Kennedy reported that, “River levels on the Lower Mississippi continue to fall, causing issues at loading facilities on the rivers as harvest is underway. Farmers who rely on river terminals to haul their new-crop corn and soybeans are facing lower basis levels because of the loadout issues and higher barge freight.”

Source : illinois.edu