Overall, November did little to dampen year-to-date (YTD) dairy export volume and value. Through 11 months, U.S. dairy export volume on a milk solids equivalent basis (MSE) is up 14% over 2019 to a total of 1,923,176 metric tons (MT) – 71,345 MT greater than the previous record year in 2018. Value is on a similar trajectory, up 10% over 2019 to $6.06 billion through November. Both volume and value have already surpassed 2019 year-end levels.

Still, falling just 0.2% in November, U.S. dairy exports declined on a milk solids equivalent basis for the first time in 2020. A 27% gain in whey products (+10,221 MT) was not enough to account for reduced volumes of NFDM/SMP (-8%, -5,193 MT), cheese (-16%, -4,509 MT), and lactose (-14%, -4,415 MT). As a higher value product on a per MT basis, the diminished cheese exports – in part caused by record high U.S. domestic prices in the summer and fall – contributed to the 5.1% decline in total value for the month.

U.S. whey exports maintain momentum

As mentioned above, U.S. whey exports delivered another month of growth in November and helped mitigate declines in milk powder, cheese and lactose. Whey volume rose 27% to 48,569 MT for the month and is up 24% YTD.

The major factors driving U.S. whey sales remain the same: heavy Chinese purchasing to support efforts to rebuild a pig herd decimated by African Swine Fever. China reported that its herd had reached about 90% of normal levels at the end of November 2020. But given that pork output is still far short of demand and dry whey pricing levels suggest strong Chinese buying activity, we expect whey import gains to persist into the new year. Reiterating what we said in last month’s summary, volumes to China “demonstrate that the market has moved from recovery to demand expansion.”

Overall, U.S. whey shipments to China more than doubled in November to 21,616 MT and were up 111% year to date. U.S. suppliers have been able to grow volume and recapture market share in large part due to the retaliatory tariff exemption secured in 2019 and renewed for another 12 months in 2020.

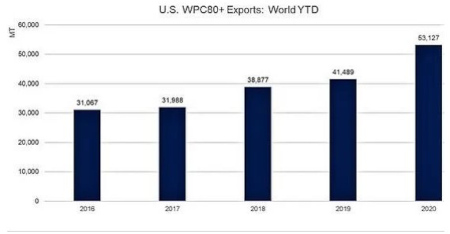

China also topped all buyers for higher value whey products (WPC80+) in November, with volume soaring 254% to 1,740 MT for the month. Reinforced by its nutritional reputation (a particular selling point over the pandemic period where we have seen populations focus more squarely than ever on healthy eating), U.S. WPC80+ exports continue to find more broad-based geographical growth, setting new records every single year since 2016. With November’s data, 2020 has already guaranteed another record year. Exports to Japan (+27%), Southeast Asia (+73%), South Korea (+165%) and the EU+UK (+294%) all saw big gains in November.

Divergent signals in Mexico

For much of this year, we have talked about Mexico buying less NFDM/SMP, a development that has driven U.S. suppliers to look elsewhere, especially to Southeast Asia. This trend abated in November with shipments of NFDM/SMP to Mexico posting the second highest month of the year behind only October, gaining 16% (+3,366 MT) over November 2019. It appears that powder demand, while still not consistently back to pre-covid levels may be on the road to recovery with an improved fourth quarter.

On the flip side, exports of cheese to Mexico weakened significantly. Reduced consumer demand inside of Mexico due to the COVID-19 pandemic and its severe economic consequences likely contributed to November’s 38% decline (-3,356 MT) in cheese exports to Mexico. The bigger factor was probably U.S. prices incentivizing international buyers to delay purchases over the summer and fall when domestic spot prices kept breaking records and cheese production was short compared to retail and food box demand. Still, despite the pandemic YTD cheese volumes to Mexico remain close to prior year levels, down just 1%.

Looking ahead, more affordable U.S. cheese towards the end of 2020 should have been the signal for international buyers, particularly in Mexico, to buy U.S. product. As a result, exports should rebound, but with more price volatility on the way, volatility in export volumes may follow.

Non-fat dry milk/skim milk powder sales to Southeast Asia slow in November

Let’s start off with some context. Through November, U.S. NFDM/SMP exports to Southeast Asia were up 50% compared to the same period last year – growth of more than 100,000 MT in 11 months. That acceleration was due primarily to a change in market share as the U.S. went accounting from 31% of total Southeast Asian NFDM/SMP trade in 2019 to 46% on an annualized basis. So, overall trade to the region is still very strong in 2020 despite November’s figures.

Still, NFDM/SMP exports to Southeast Asia in November represented a slowdown in the pace we have become accustomed to. Exports to the six major markets of the region (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) dropped 27% (-7,399 MT). Shipments to Indonesia grew by 22% (+1,597 MT), but exports to the other destinations declined. Vietnam declined the most (-2,885 MT) followed by the Philippines (-2,686 MT), Malaysia (-2,314 MT), and Thailand (-1,099 MT).

The question remains “Why?” and “Should we expect this to persist?”

As to why – there were likely multiple factors all at play. A 46% share of trade for any supplier is well above the norm in such a highly competitive region with European, New Zealand and Australian suppliers all focused on gaining business. Thus, some regression in market share or volumes was to be expected.

Click here to see more...