Analysts are having a hard time modeling out the soybean oil needs in the near term and long term as more renewable diesel projects are announced. For now, forecasts call for higher soybean prices, expanded acreage, and not enough soybean oil to go around.

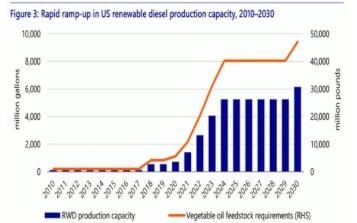

A look at renewable diesel production, including the forecast through 2030 by Rabobank. The blue charts show renewable diesel capacity while the orange line shows the vegetable oil needs it will take to meet that demand. (Image from Rabobank: The Rush to Crush, September 2021)

If everything is built out as projected, farmers would have to add tens of millions of acres of soybeans and yield increases to keep up with the crush demand. To hit the numbers, soybean production would have to grow by roughly 3.6 billion bushels by 2030.

USDA’s Economic Research Service this week projected soybean oil will see greater demand starting in 2022, while Rabobank offered a similar outlook projecting greater crush capacity starting in 2023 as more renewable diesel facilities come online.

Renewable diesel right now has multiple government policies driving new production. The Renewable Fuel Standard generates renewable identification numbers, or RINs, for renewable diesel. Then there is the $1-per-gallon Biodiesel and Renewable Diesel Tax Credit that is set through 2022 but could be extended through 2026 in the Build Back Better Act.

California’s low-carbon fuel standard (LCFS) is the biggest factor right now as California and a few other states move to decarbonize liquid fuels. Under California’s law, there are a lot of products and pathways to reduce emissions, but renewable diesel has taken hold.

“They (California) put together their law to meet their annual goals of reducing carbon emissions, which is an admirable goal, and we’ll make that comment up front,” said Steve Nicholson, senior grains and oilseed analyst at Rabobank.

That’s ramped up production to the point renewable diesel is now the single-largest fuel segment for generating LCFS credits at $153 per carbon ton, down in value about $32 a ton since early July. While each facility gets a different carbon score, an LCFS credit generally translates into 83 cents to 86 cents a gallon for renewable diesel or biodiesel.

Oil refiners are helping drive the move to renewable diesel by modifying their refineries or building new ones. They are also increasingly partnering with agricultural companies to make that happen.

Click here to see more...