By Gary Schnitkey and Nick Paulson et.al

Department of Agricultural and Consumer Economics

University of Illinois

By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

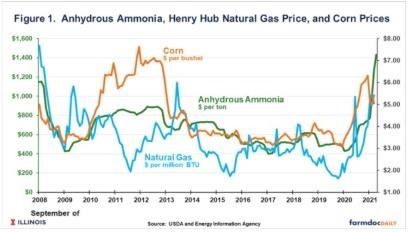

Nitrogen fertilizer prices are positively related to corn and natural gas prices. Because of current high corn and natural gas prices, one would expect nitrogen prices also to be high. However, in recent months, anhydrous ammonia prices have exceeded levels one would expect, even given higher corn and natural gas prices. Supply disruptions caused by Hurricane Ida may help explain recent high prices, but other factors could also be in play. In any case, high nitrogen fertilizer prices are likely into the spring, which suggests that large reductions in nitrogen rates need to occur.

Nitrogen Prices Continue to Increase

Since summer, nitrogen prices have risen dramatically, reaching record-high levels (see Figure 1). According to the most recent data from the Agricultural Marketing Service, nitrogen prices have continued to rise into December. On December 3rd, the average price in Illinois for anhydrous ammonia was $1,434 per ton, up by $91 per ton from the price two weeks prior. Since last December, anhydrous ammonia prices have increased $960 per ton, more than doubling in price.

Factors Explaining Nitrogen Prices

Nitrogen fertilizer prices have historically been related to two fundamental factors: corn prices and natural gas prices.

Corn Prices: Over time, rising corn prices coincide with rising anhydrous ammonia prices and vice versa. For example, monthly anhydrous ammonia prices in Illinois have a .72 correlation with national average corn prices reported by the National Agricultural Statistics Service (NASS).

Two reasons have been advanced for this correlation. The first is that rising corn prices can signal more corn acres and more nitrogen fertilizer use. Higher demand for nitrogen fertilizer leads to higher nitrogen prices. A second reason is that higher corn prices mean more income for farmers and a higher ability to pay. As a result, fertilizer manufacturers charge higher prices when corn prices are high. Either reason explains a positive relationship between ammonia and corn prices.

Natural gas prices: Natural gas is a significant input into producing anhydrous ammonia. As a result, higher natural gas prices are expected to lead to higher anhydrous ammonia prices. From 2008 to 2020, there is a .46 correlation coefficient between ammonia prices and natural gas prices at the Henry Hub.

Explanatory Power of Corn and Natural Gas Prices

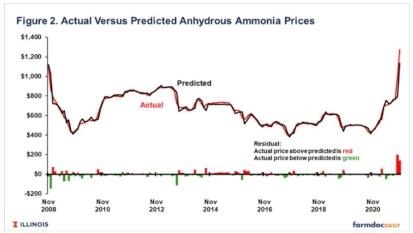

Until October 2021, the Illinois price of anhydrous ammonia was explained very well by corn and natural gas prices. To illustrate, a statistical regression model that explains Illinois’ anhydrous ammonia price was fit. This model uses monthly price observations from 2008 to November 2021. The price variables in the model are:

Corn price. The national average corn price reported by the NASS was used (see Figure 1). Corn prices were statistically significant. The model indicates that higher corn prices increase ammonia prices and vice versa.

Natural gas price. The monthly natural gas price at Henry Hub was used (see Figure 1). These gas prices are reported by the Energy Information Agency, an agency of the U.S. Department of Energy. The model indicates that higher natural gas prices increase ammonia prices and vice versa.

Lagged anhydrous ammonia prices. As with most economic relationships, there are lagged relationships. Lagged ammonia prices capture this time dimension. Inclusion or exclusion of lagged ammonia prices does not change the statistical significance or signs of the coefficients associated with corn and natural gas prices.

For most of the period, the model has an excellent fit, meaning the predicted values closely match the actual values (see Figure 2). The model explains 95% of the variability in anhydrous ammonia prices. The actual values and the model predictions for anhydrous ammonia prices are within $50/ton of each other most of the time.

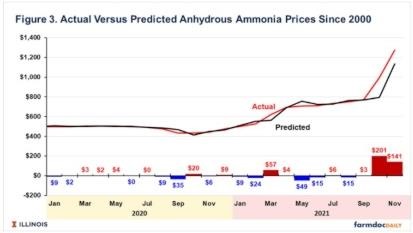

However, the closeness of the fit breaks down in October and November 2021 (see Figure 3). In October 2021, the model predicted a price of $795 per acre while the actual price was $996 per ton. In this month, the model’s prediction differed from the actual value — also known as the residual — by $201 per ton ($996 actual value – $795 predicted value). In addition, there was another large under-prediction (i.e., residual) of $141 per ton in November 2021.

Commentary

Then, a central question is: What happened this fall that caused ammonia prices to deviate from their typical relationships with corn and natural gas prices? Supply disruptions caused by Hurricane Ida shuttering ammonia plants could have led to short supplies leading to higher prices. While a reasonable explanation, other factors could have led to higher ammonia prices.

If corn and gas prices remain at their current levels, the fitted model predicts an anhydrous ammonia price near $1,000 per ton in April 2022, a decline from present levels but still very high. However, we note that the predictive power of this model has declined in recent months, such that confidence in predictions from the model have diminished. In any case, it seems reasonable to expect very high nitrogen fertilizer prices in spring.

Source : illinois.edu